Streaming video these days is starting to be a more complicated animal than most expected. Disney (NYSE:DIS) now begins to suffer ill effects from the unusually complex industry of streaming, bad enough to where even analysts are turning on the company. Disney is down fractionally in Friday afternoon’s trading, so investors may not be as concerned as the analysts appear to be.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The hit Disney took today traces back to Peter Supino, Wolfe Research analyst who downgraded Disney from “outperform” to “peer perform,” which is basically from Buy to Hold. Supino issued his downgrade due to several key factors, including Disney+ subscriber forecasts that are less than reliable, ongoing issues with the state of linear TV, and the value of already-produced content against current cash spending.

Indeed, Disney+ lost another four million subscribers in the first quarter of 2023. Since that includes most of winter—which is prime time for staying indoors and watching television—that’s particularly bad news. But this is actually the second drop in a row for Disney+ subscriber figures, and that only makes matters worse. However, Disney did manage to cut its losses. It recorded a loss of $400 million on streaming, and that’s down 26% from what it was this time last year.

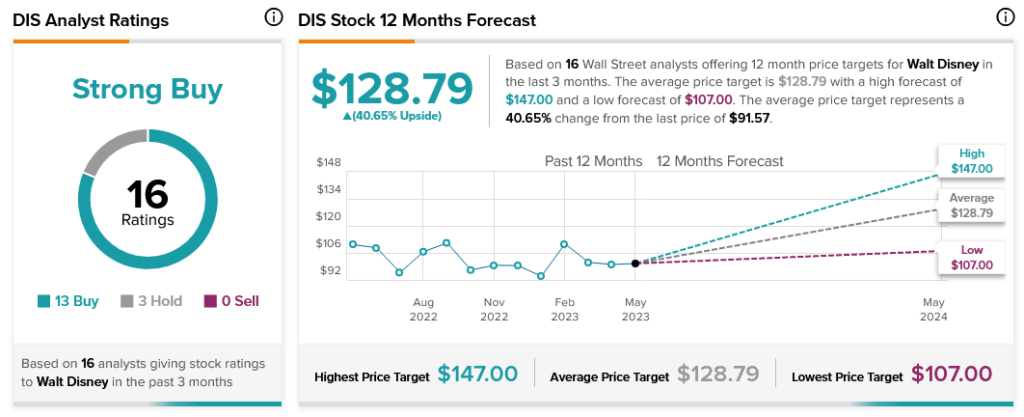

Investors seem little deterred by this news, and so too, are most analysts. With 13 Buy ratings and three Holds, analyst consensus calls Disney stock a Strong Buy. Plus, with Disney stock’s average price target of $128.79, it also offers investors 40.65% upside potential.