Disney shares (NYSE:DIS) are down in this afternoon’s trading, mainly because the results for Avatar’s latest release may be in trouble. “Avatar 2: The Way of Water” posted an impressive box office weekend. It cleared $134 million in domestic markets, and reports note the global box office was roughly three times that at $435 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, that’s not what analysts were expecting. Analysts expected the movie to pull in over $170 million in its opening weekend. The film also broke a record, bringing in the highest December opening figure for IMAX ticket sales of all time with $48.8 million.

There are concerns that “Avatar 2” will lose steam the closer we get to Christmas and may not break the levels Disney wanted to see. The movie cost $460 million to make. Worse, that number doesn’t consider P&A activity. Thus, Disney needs a few more weekends like the opening weekend in order to even recoup its costs.

With “Avatar 2” originally expected to be a box-office masterpiece, this implies significant risk going forward. However, the current calendar of upcoming box-officer releases says that there’s not much else coming out soon. Thus, “Avatar 2” may have its chance after all.

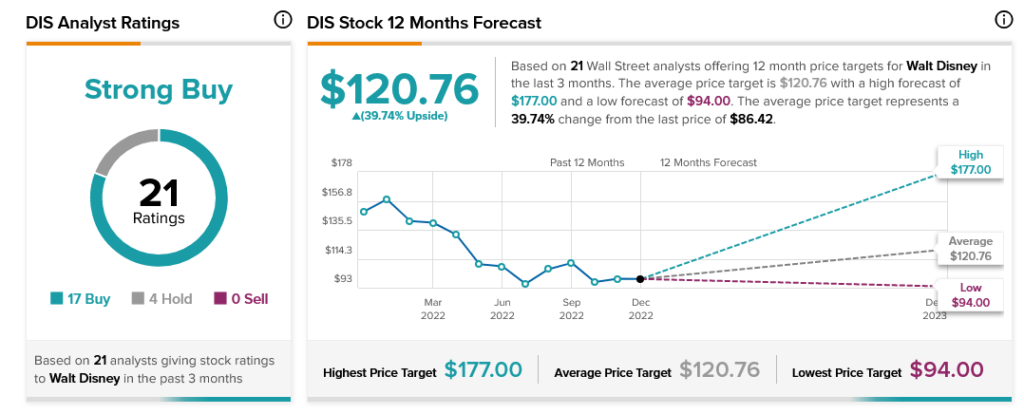

Disney may be having troubles, but it’s still a strong pick by analysts’ reckoning. Analyst consensus calls Disney a Strong Buy, with over four times the number of Buy recommendations as Hold. With a current price target of $120.76, the stock has 39.74% upside potential.