Disney (DIS) has another box office success on its hands with the live-action remake of Lilo & Stitch. The film pulled in $183 million from the domestic box office and $341.7 million globally during its opening weekend. That’s a huge win for Disney, as the film’s budget was only $100 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The strong performance of the live-action Lilo & Stitch also easily outperforms the original animated version, which made a total of $273.1 million from its box office run in 2002 on an $80 million budget. However, when adjusted for inflation, the traditionally-animated film is still ahead of its live-action remake, with a box office of roughly $486.99 million.

Even so, there’s no denying the success of Lilo & Stitch, as its box office earnings fueled the strongest Memorial Day weekend in history. It was helped by Paramount’s (PARA) Mission: Impossible — The Final Reckoning’s $77 million domestic and $190 million global box office. This also resulted in Lilo & Stitch securing the position of highest-grossing opening for a Memorial Day weekend.

What Was Behind Lilo & Stitch’s Success?

Nostalgia played a huge role in the box office records set by Lilo & Stitch. The film pulled in a large number of Gen Z and Millennial women, who grew up with the animated original and its subsequent direct-to-DVD films and TV series. As a result, 60% of tickets sold went to non-parents and kids. Latinos also strongly contributed, with a 33% turnout.

Disney’s 2025 box office performance reached a major milestone with the release of Lilo & Stitch. It has generated $787 million in domestic box office earnings and surpassed $2 billion on the global stage. It also has several more potential box office winners lined up for 2025, including, The Fantastic Four: First Steps, Tron: Ares, Zootopia 2, and Avatar: Fire and Ash.

Is DIS Stock a Buy, Sell, or Hold?

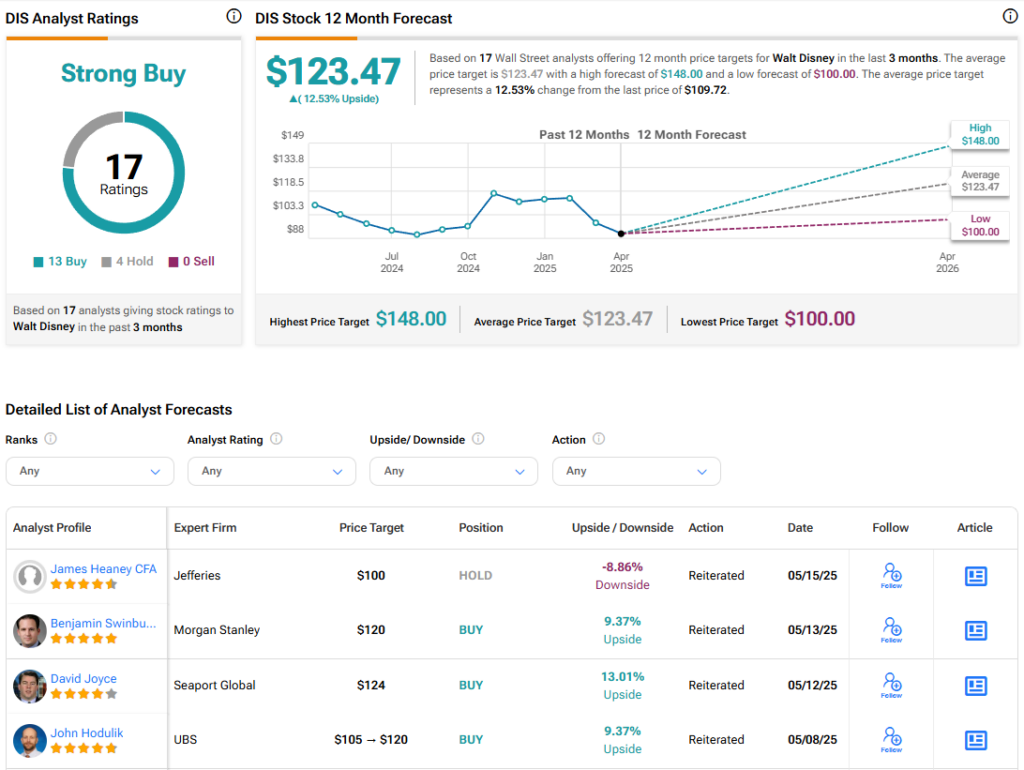

Turning to Wall Street, the analysts’ consensus rating for Disney is Strong Buy, based on 13 Buy and four Hold ratings over the last three months. With that comes an average DIS stock price target of $123.47, representing a potential 12.53% upside for the shares.