Shares of The Walt Disney Company (NYSE:DIS) trended 4% higher in Thursday’s pre-market trading, as the media and entertainment giant impressed investors with upbeat earnings for the fourth quarter of Fiscal 2023. Moreover, CEO Bob Iger raised the annual cost reduction target by $2 billion to $7.5 billion, with the company continuing to drive further efficiency across major businesses, including the streaming business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Focus on Profitability

Disney’s Q4 FY23 adjusted earnings per share (EPS) improved considerably to $0.82 from $0.30 in the prior-year quarter, surpassing analysts’ consensus expectation of $0.71. The bottom line gained from higher revenue and the company’s restructuring efforts. Management said that the company’s restructuring initiatives drove significant efficiencies, especially in the streaming unit, with the company now targeting an extra $2 billion in cost reductions.

Iger highlighted that Disney’s restructuring efforts improved the operating results of its combined streaming businesses by about $1.4 billion from Fiscal 2022 to Fiscal 2023. The CEO assured investors that about turning the combined streaming businesses profitable in the fourth quarter of Fiscal 2024.

It is worth noting that Disney continues to drive further efficiency in its content spend. The company expects a total content spend of about $25 billion in Fiscal 2024, down $2 billion compared to Fiscal 2023. The company added that excluding strike impacts and sports rights, its annualized entertainment cash content spend reduction target now stands at $4.5 billion, compared to the previous target of $3 billion.

Management clarified that it has eliminated 8,000 roles as part of its cost reduction and streamlining efforts and is not planning further significant job reductions. Overall, the company is aggressively cutting costs at a time when pressure from activist investor Nelson Peltz is rising.

Is Disney a Buy Right Now?

In reaction to the results and management’s commentary, Goldman Sachs analyst Brett Feldman lowered his price target for DIS stock to $120 from $125 but reaffirmed a Buy rating on the stock, saying, “DIS is making progress against management’s lengthy to-do list.”

Feldman specifically highlighted the company’s cost-saving initiatives and the rise in the targeted run-rate for annual cost savings to $7.5 billion. He noted that management expects the positive impact of these initiatives to reflect in its Fiscal 2024 free cash flow, which is estimated at about $8 billion and marks a material increase from $4.9 billion in Fiscal 2023 and nearly matches pre-COVID cash generation.

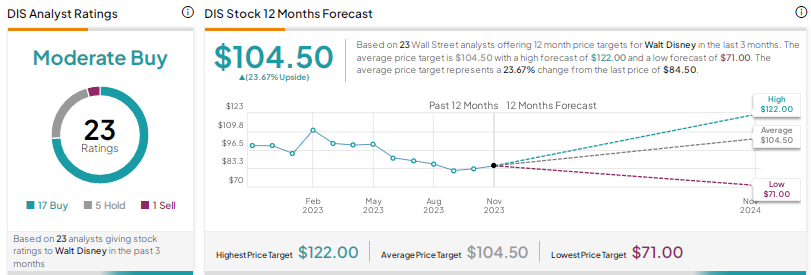

Wall Street is cautiously optimistic on DIS stock, with a Moderate Buy consensus rating based on 17 Buys, five Holds, and one Sell. The average price target of $104.50 implies nearly 24% upside potential.