The board of directors of the Walt Disney Company (NYSE:DIS) has unanimously voted to extend the contract of CEO Robert Iger by two years, until the end of 2026. DIS stock is rising higher in pre-market trading on the news, up 1.1% as of the last check.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Iger rejoined Disney as CEO in November 2022 for a short stint and helped find the company a suitable candidate for the post. However, the company has failed to find an apt replacement and has requested that Iger continue navigating the entertainment giant through challenging times. Iger’s contract extension proposes an annual performance bonus of up to 500% of his annual base salary.

Commenting on the extension, Iger said, “The importance of the succession process cannot be overstated, and as the Board continues to evaluate a highly qualified slate of internal and external candidates, I remain intensely focused on a successful transition.”

Disney’s Current Challenges

In the past, Iger has been instrumental in shaping Disney’s business successfully. The board has full faith in his ability to steer the company through the current transformation. Disney is making efforts to monetize its streaming business while navigating challenges posed by box office failures and undertaking cost-cutting measures.

The House of Mouse company also faces the heat from the government in Florida, where the Don’t Say Gay debate took an ugly turn this year. Simultaneously, Disney’s theme parks are also witnessing a slump in footfall. The company recently saw one of its most lackluster Independence Day Weekends in years, and Disney has been anticipating lower earnings from theme parks this year. Amidst all the challenges, Iger seems to be the only fit leader who can successfully drive Disney out of its problems. DIS stock is up marginally by 1.3% so far this year.

Is Disney Stock a Buy or a Hold?

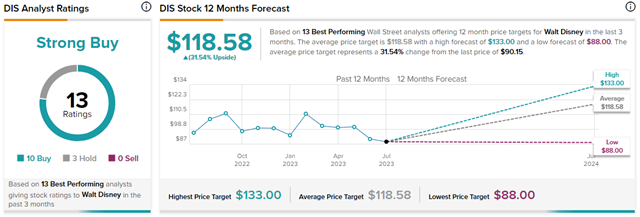

Wall Street remains cautiously optimistic about Disney’s stock trajectory owing to the multiple issues. However, out of the top 13 analysts who recently rated Disney, ten have given it a Buy rating and three have given it a Hold rating. Top Wall Street analysts are those awarded higher stars by TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on the top analysts’ views, Disney has a Strong Buy consensus rating on TipRanks. The average Walt Disney price forecast of $118.58 implies 31.5% upside potential from current levels.