The Walt Disney Co. (NYSE: DIS) announced ticket price hikes at its Disneyland and Walt Disney World theme parks in California and Florida, respectively. The company stated that it will raise the price of its single-day admission at Disneyland on its highest-demand days by 9% to $194, while multi-day passes and other tiers will see price increases in the range of 3.9% to 8.9%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The entertainment and media conglomerate stated that the lowest price for Disneyland and California Adventure will remain at $104, while a two-day ticket will go up to $310 from $285, an increase of 8.8%.

Disneyland’s Genie+ program, which allows park visitors to skip lines, will see a price hike to $30 from $25. Meanwhile, the Enchant annual pass will see a rise of 21% to $849, with parking costs rising too. In Florida, price hikes are similar, affecting annual pass tiers and parking charges.

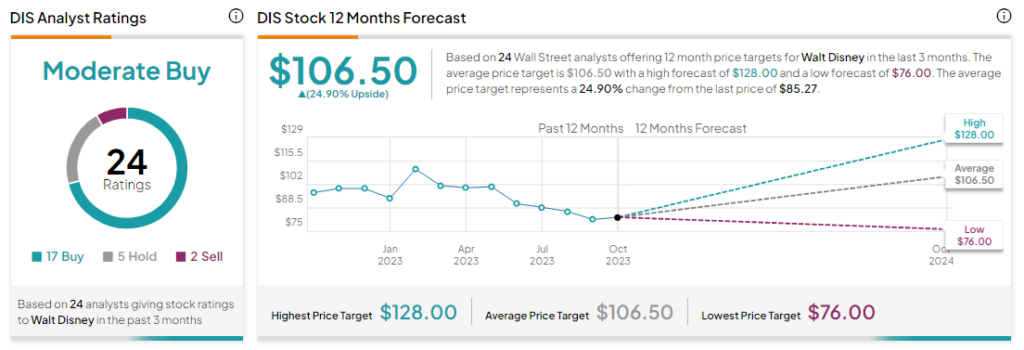

Is Disney Stock a Buy or a Hold?

Analysts are cautiously optimistic about Disney, with a Moderate Buy consensus rating based on 17 Buys, five Holds, and two Sells. The average Disney price target of $106.50 implies an upside potential of 24.9% from current levels.