Once the market action comes to a stop today, all eyes will be on Walt Disney (NYSE:DIS) with the entertainment giant set to release its fiscal first quarter of 2024 report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ahead of the anticipated print, Deutsche Bank analyst Bryan Kraft has been making some adjustments to his Disney model.

Given the weak box office performance of The Marvels and Wish, the analyst has reduced his Studio OI (operating income) estimates for F1Q. The figure goes from -$3 million previously to -$343 million. Moving forward, with the prospect of only two surefire successes in 2024 (Deadpool 3 and Inside Out 2, according to Kraft), the analyst anticipates F2024 will be a “light year” for Disney’s film business.

However, with films from the Captain America, Lion King, and Moana franchises, among others, set for a F2025 release, next year will offer a more “robust slate.” The following year (F2026) will bring with it the return of the Avengers and Avatar.

Elsewhere, after taking a deep dive into his cost assumptions and driven by lower sports rights costs, the analyst has made a big increase to the Sports OI estimate for F1Q. That figure goes from -$206 million previously to +$85 million. However, that is set to be meaningfully countered by developments later this year. Due to Zee reportedly turning its back on the sublicensing agreement with Disney for broadcast TV rights to ICC events, there is a serious headwind coming in F3Q.

“We believe this means significantly lower licensing revenue than Disney would have booked in F3Q,” Kraft explained. That said, Kraft expects the rights will end up being broadcast on Star and should result in Disney generating $150 million in ad revenue during the fiscal third quarter.

In another part of the business, on account of lower expenses due to the talent strikes’ impact on the availability of new scripted content, Kraft has also raised his Linear Entertainment TV OI estimates for F1Q and FY24.

Bottom-line, all the changes ultimately result in the F2024 consolidated OI estimate declining by 1%, while Kraft’s F2025’s OI estimate increases a tad.

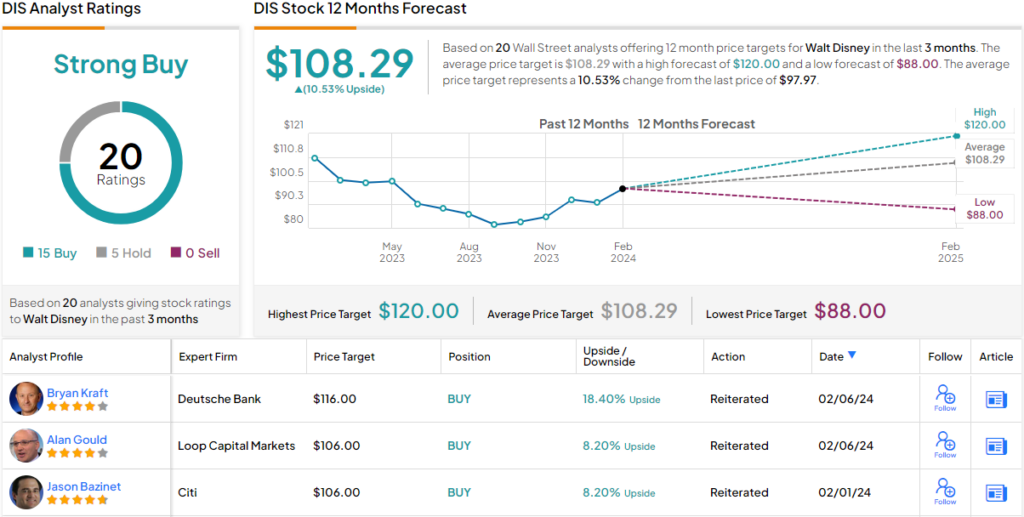

To this end, Kraft has boosted his price target on DIS stock from $115 to $116, suggesting the shares will post returns of 17% in the year ahead. Kraft’s rating stays a Buy. (To watch Kraft’s track record, click here)

Amongst Kraft’s colleagues, 14 others join him in the bull camp, while 5 others remain on the sidelines, all culminating in a Strong Buy consensus rating. At $108.29, the average target makes room for 12-month returns of 10.5%. (See Disney stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.