Disney (NYSE:DIS) has faced down a lot of competition in its time. It took on Warner Bros (NASDAQ:WBD) as the biggest name in animation for decades. It faced off against a panoply of streaming video companies to seize market share for Disney+. And now, it finds that the government of Florida itself is against it. Yet with the stock down only fractionally in Monday’s trading, Disney—and CEO Bob Iger, by extension—has quite a bit of shareholder support on its side.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Iger leveled a charge at Florida governor Ron DeSantis that likely few had ever heard in connection with him: that he was “anti-business.” The matter goes back to the Parental Rights in Education Act, otherwise known as the “Don’t Say Gay” bill. Such moves would keep classrooms from discussing sensitive topics like gender identity, among other things. Disney originally kept quiet but later took a stand on the bill. Florida’s government, meanwhile, found that stand distasteful and hit Disney in the pocketbook, revoking its special rights over the massive spread of real estate on which Walt Disney World sits.

Shareholders, in turn, gathered in support of Iger. One proposal recently offered for shareholder vote wanted Disney to provide annual reports about its connection to China. Not only in raw materials but also in finished goods for sale, theme park revenue levels, and even outright labor. The proposal was voted down. So too, was a proposal calling for Disney to offer more insight into its charitable contributions. Shareholders also supported a slate of nominees for the company’s board, including both Iger as CEO and Chairman Mark Parker. Some, however, were likely dismayed to hear Iger note that the Premier Pass would not return. Iger cited low demand for this product’s removal.

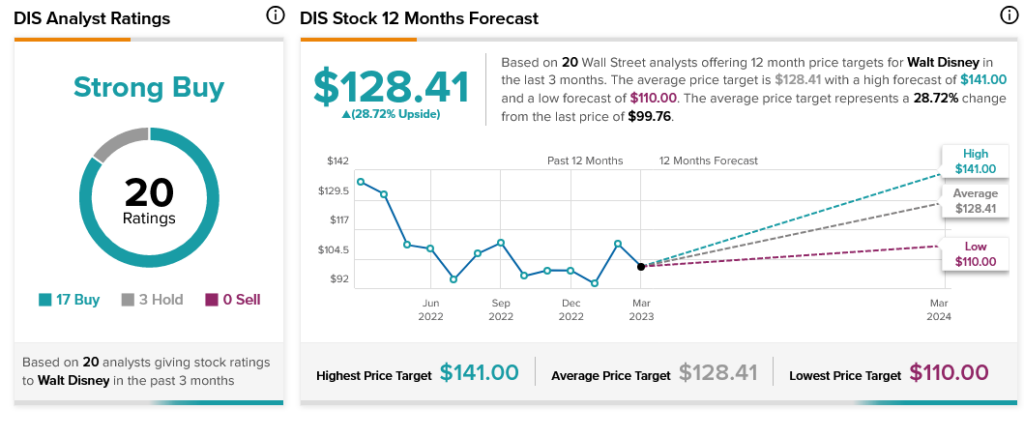

Shareholders support Disney quite well, but so too do analysts. Analyst consensus calls Disney stock a Strong Buy with 17 Buy recommendations to just three Holds. Further, Disney stock also offers 28.72% upside potential thanks to its average price target of $128.41.