Just days after movie theater chain AMC Entertainment (NYSE:AMC) finally settled its legal woes over the APE units, along comes more trouble for the chain. The kind of trouble that sends shares down over 25% in Wednesday morning’s trading as well, as AMC tries to fire up its printing presses and sell a huge new slug of shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A recent filing with the SEC revealed that AMC wants to sell as many as 40 million new shares of Class A common stock. It’s already entered into an equity distribution agreement with several major brokers, including the likes of B. Riley, Goldman Sachs, and Citigroup, to serve as sales reps on the equity stake. Income derived from the share sales will go to several purposes, starting with debt servicing, improving liquidity, and the always-popular “general corporate purposes.”

Naturally, investors aren’t taking the notion of further share dilution lightly. But it comes at a very unusual time for AMC, as it may have hit upon a major new market move. October 13, as some are already quite aware, will mark the appearance of “Taylor Swift: The Eras Tour” in theaters. While it will have some competition from more mainstream cinematic fare, analysts are already considering a huge new possibility for AMC. Eric Wold, analyst with B. Riley Securities, called it a “…new focus of management to boost overall profitability….” It’s not the first time this has been tried—Fathom Events, anyone?—But Swift’s undeniable star power might just make it a serious possibility in the future.

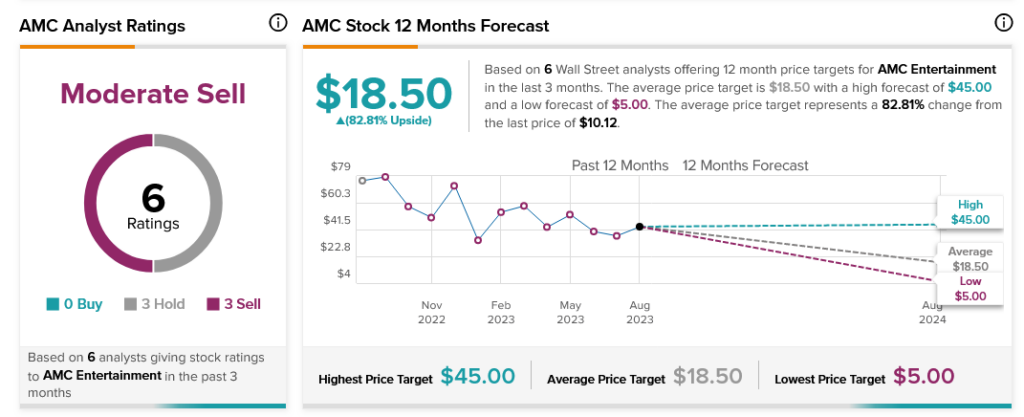

Yet, not every analyst is so enthusiastic. Currently, analyst consensus calls AMC stock a Moderate Sell, supported by three Hold ratings and three Sells. Further, with an average price target of $18.50, AMC stock offers investors a whopping 82.81% upside potential.