Walt Disney (DIS) stock gained over 8% in pre-market trading following its better-than-expected fiscal Q2 results and upbeat full-year earnings outlook. Importantly, the entertainment giant saw robust growth in Disney+ and Hulu subscribers, reflecting its strong position in the streaming market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In detail, Q2 revenues rose 7% year-over-year to $23.6 billion. Also, adjusted earnings per share for the quarter rose to $1.45 from $1.21 in the same period a year ago. The reported figures beat analysts’ estimates of $1.19 and $23.09 billion.

Disney+ Subscriber Growth Beats Estimates

A key highlight of the report was the growth in Disney+ subscribers. Disney+ added 1.4 million subscribers, reaching 126 million in Q2, against the company’s expectations of a “modest decline” from the 124.6 million subscribers in Q1. This also beat analyst estimates of 123.6 million.

Also, Hulu added 1.3 million subscribers in Q2, bringing its total to 50.3 million, up from 49 million at the end of 2024. Overall, Disney’s Entertainment segment delivered a 9% year-over-year increase in revenues, driven by strong streaming growth and content licensing revenue.

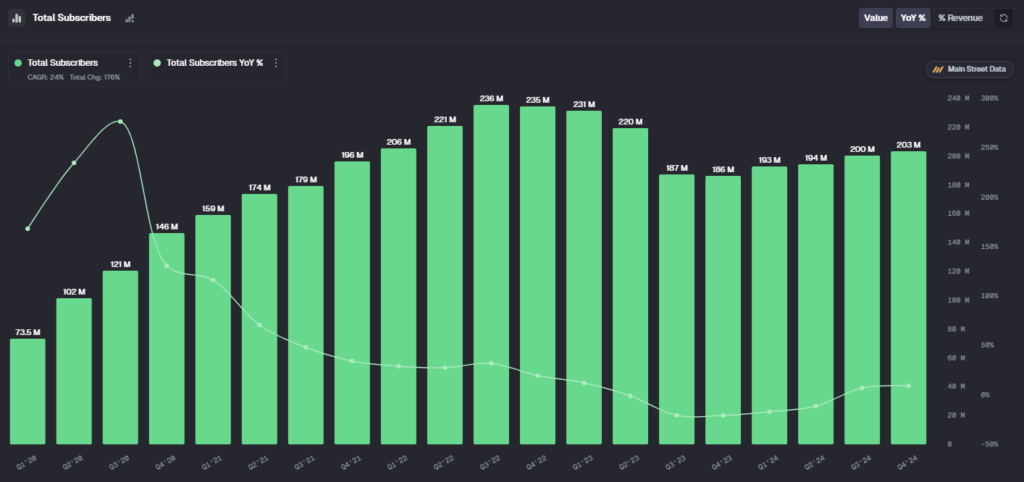

According to Main Street Data, the company’s subscriber growth is picking pace again. After dropping in Q3 2023, the numbers have risen gradually.

Also, Disney’s Experiences segment grew 6.4% year-over-year in Q2, driven by strong theme park attendance and higher cruise line revenue. Importantly, DIS announced the opening of a new theme park and resort in Abu Dhabi, marking its first-ever Middle Eastern destination.

DIS Fiscal 2025 Outlook Positive

Looking ahead, Disney raised its adjusted EPS forecast for Fiscal 2025 to $5.75, marking a 16% increase from Fiscal 2024. Previously, the company projected EPS growth in the high-single-digit range.

Further, Disney anticipates a “modest increase” in Disney+ subscribers in fiscal Q3 compared to the previous quarter.

Is Disney Stock a Buy or Sell?

Analysts remain bullish about DIS stock, with a Strong Buy consensus rating based on 12 Buys. Year-to-date, DIS stock has decreased by more than 17%, and the average DIS price target of $124.08 implies an upside potential of 34.62% from current levels.