Shares of cloud computing platform operator DigitalOcean (NYSE:DOCN) experienced a boost at the time of writing, even though Bank of America Securities took a bearish turn on its prospects, shifting its rating from “Buy” to “Sell.” The investment bank, expressing concerns about a significant slowdown in website traffic since the onset of the year, anticipates worsening customer growth and increased churn in the upcoming period. Citing a challenging macroeconomic landscape, BofA analyst Wamsi Mohan highlighted potential obstacles in acquiring new customers and increasing average revenue per user (ARPU).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, DigitalOcean’s clientele, which consists mainly of startups and small to mid-sized enterprises, are deemed most vulnerable to inflationary pressures. This is reflected in the company’s recent move to trim its 2023 revenue projection to a range of $680 to $685 million, a significant step down from its optimistic Q1 forecast of $700 to $720 million.

Is DOCN Stock a Good Buy?

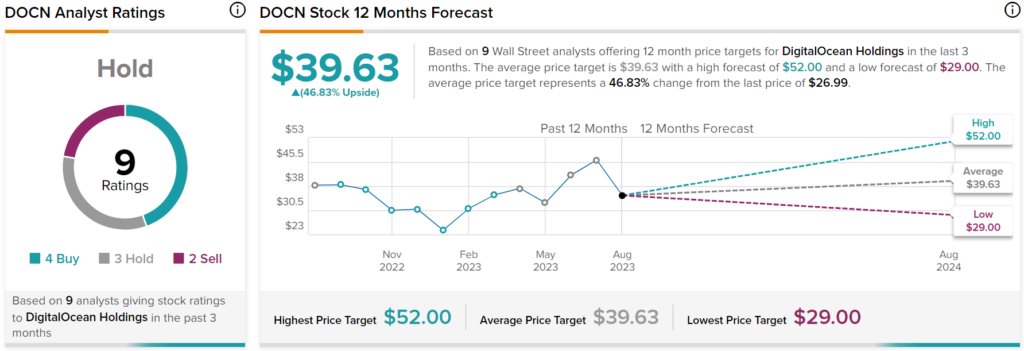

Overall, analysts have a Hold consensus rating on DOCN stock based on four Buys, three Holds, and two Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $39.63 per share implies 39.63% upside potential.