Shares of sporting goods retailer DICK’s Sporting Goods (NYSE:DKS) are down in double digits today after its second-quarter numbers fell short of expectations on both the top line and bottom line fronts. Despite a 3.6% year-over-year increase in revenue to $3.22 billion, the figure lagged estimates by $20 million. Moreover, EPS at $2.82 fell significantly below expectations by a wide margin of $0.99.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, DICK’s opened seven new House of Sport outlets and saw an uptick of 1.8% in comparable store sales. The company is witnessing an impact from elevated inventory shrinkage and is undertaking a business optimization process to streamline its cost structure. It has already done away with certain positions in customer support and expects the business optimization drive to conclude during fiscal 2023.

In the wake of its Q2 performance, DICK’s has also moderated its financial outlook. For the full year 2023, it now expects EPS to range between $11.33 to $12.13 as compared to earlier expectations between $12.90 to $13.80. Comparable store sales for the year are anticipated to be flat to a positive increase of 2%.

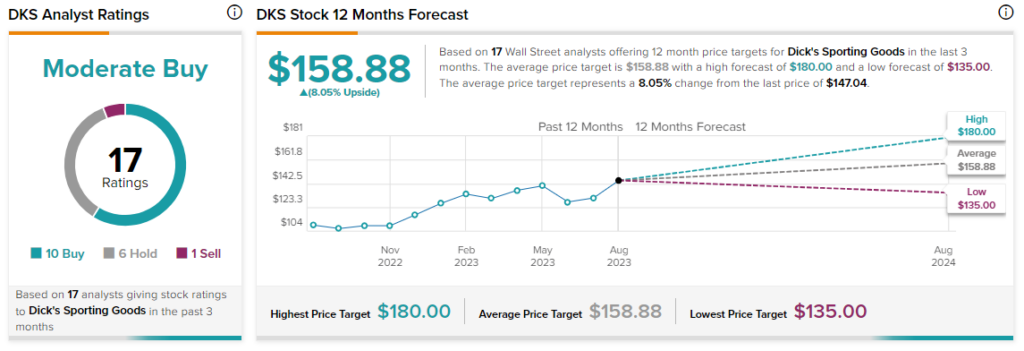

Overall, the Street has a $158.88 consensus price target on DICK’s, along with a Moderate Buy consensus rating. Short interest in the stock currently stands at nearly 11.8%.

Read full Disclosure