Devon Energy Corp. (NYSE: DVN) has reported better-than-expected first-quarter 2022 earnings on the back of Delaware basin production growth and margin expansion. Meanwhile, revenues met expectations. Additionally, the company provided a strong outlook and boosts capital deployment activities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the update, shares of the Oklahoma-based energy company rose 2.74% in the extended trading session on Monday.

Results in Detail

Devon posted adjusted earnings of $1.88 per share, which surpassed the Street’s estimate of $1.75 per share. Total revenue stood at $3.81 billion in the quarter, up 85.9% year-over-year, and met analysts’ expectations.

Total production stood at 575,000 Barrel of Oil Equivalent (BOE) per day, up 15.2% year-over-year. Delaware Basin production volume drove the results. Remarkably, oil accounted for 50% of the total volume. The production was reduced by 15,000 BOE per day, impacted by the winter season.

Delaware Basin production stood at 394,000 BOE per day, up 27% year-over-year. For the remaining period of 2022, Devon remains on track to make 220 new wells operational.

While the company’s adjusted EBITDAX came in at $2.14 billion, its capital expenditures stood at $564 million. Adjusted free cash flow was at a record-high $1.3 billion.

Guidance

The CEO of Devon, Rick Muncrief, said, “Looking ahead, we are unwavering in our commitment to capital discipline and remain focused on delivering the objectives that underpin our current year plan. Our pursuit of value over volume is further reinforced by the steep backwardation in commodity prices, supply chain constraints and the economic uncertainty arising from recent geopolitical events.”

For the second quarter of 2022, the company projects total oil production in the range of 585 million BOE per day to 604 million BOE per day. Total capital expenditures are anticipated in the range of $570 million to $640 million.

For 2022, Devon expects total oil production to range between 570 million BOE per day and 600 million BOE per day. Total capital expenditures are forecast in the range of $2.06 billion to $2.44 billion.

Capital Deployment

Devon’s board of directors has announced an increased fixed-plus-variable dividend of $1.27 per share, up 27% from the prior quarter. The new dividend will be paid on June 30 to shareholders on record as of June 13.

As part of its cash-return strategy, the company also increased the share repurchase authorization to $2 billion of its common stock through May 4, 2023. As of April’s end, Devon repurchased 19.1 million shares for a total cost of $891 million.

“This strong financial performance has enabled us to dramatically accelerate the return of capital to shareholders by declaring the highest dividend in Devon’s history and by expanding our share-repurchase program to further bolster per-share results,” Muncrief commented.

Wall Street’s Take

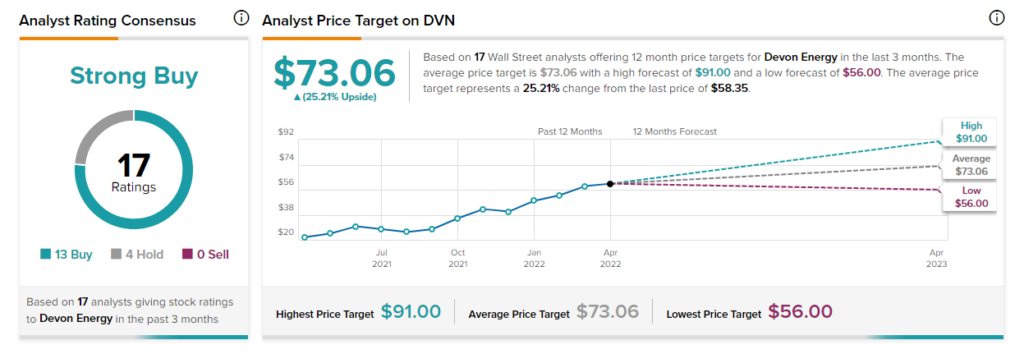

Shares of Devon have skyrocketed 163.55% over the past year, and the stock scores a Strong Buy consensus rating based on 13 Buys and four Holds. The average Devon price target of $73.06 implies a 25.21% upside potential.

Investor Wisdom

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Devon, with 16.3% of investors maintaining portfolios on TipRanks increasing their exposure to DVN stock over the past 30 days. Furthermore, 1.8% of these individuals have increased their holdings in the recent week.

Concluding Remarks

With strong production, robust earnings, high analyst ratings, appreciable capital-deployment activities, decent outlook, and stock price performance as considerable factors, investors might consider a stake in Devon for potential long-term gains.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Unilever Scathed as Inflation Hits Consumer Goods Sector

Twitter & Elon Musk Alliance: What’s More?

Bristol Myers Turns Triumphant with Upbeat Q1 Results & Mavacamten Approval