The carriage dispute between The Walt Disney Co. (NYSE:DIS) and Charter Communications (NASDAQ:CHTR) has rattled the media industry, but top-rated Deutsche Bank analyst Bryan Kraft thinks that the media giant is likely to give in on its demand.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst has predicted Disney’s probable concession on carriage minimums and contract length. Kraft anticipates Charter agreeing to pay Disney’s subscriber rates while also including Disney’s streaming apps for Charter subscribers. The analyst has suggested that a distribution deal is likely to be reached via Xumo, co-owned by Charter and Comcast, which could resolve the standoff.

However, Charter’s hint at exiting the video business could pose a greater challenge for Disney, accelerating revenue declines from linear channels and complicating future distribution deals. The outcome remains uncertain in this high-stakes media clash.

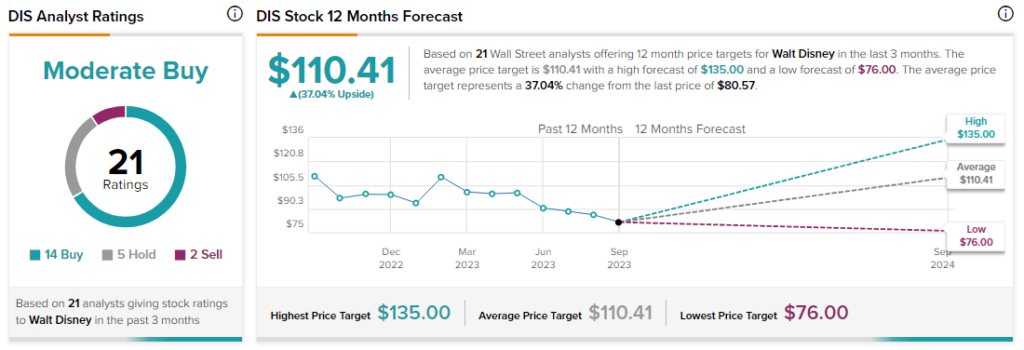

Kraft has a Buy rating and a price target of $120 on the stock, implying an upside potential of 48.9% from current levels.

Overall, analysts are cautiously optimistic about DIS stock, with a Moderate Buy consensus rating based on 14 Buys, five Holds, and two Sells.