Ahead of electric vehicle (EV) maker Tesla’s (TSLA) third-quarter deliveries update, Deutsche Bank analyst Edison Yu hiked his price target for TSLA stock to $435 from $345 and reiterated a Buy rating. While Yu expects stronger Q3 volumes, he attributed the increase in his price target to a higher multiple in Tesla’s robotaxi and humanoid robot businesses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

TSLA stock has risen 21% over the past month, bringing the year-to-date movement to 5%.

Deutsche Bank Is Bullish on TSLA Stock

Yu expects Tesla to report stronger Q3 deliveries, but kept his full-year 2025 and 2026 outlook essentially unchanged. He estimates Tesla to report Q3 deliveries of 461,500 vehicles, roughly flat year-over-year but up 20% compared to the previous quarter. Yu’s estimate indicates that Tesla’s Q3 deliveries are tracking significantly ahead of the consensus estimate of 433,000, backed by the Model Y L launch in China and the U.S. pre-buy effect ahead of the end of EV tax credits. Yu expects more than 20% growth in both China and North America, with some decline in Europe as competition and branding continue to impact demand.

Looking at the full year, Yu noted that the consensus estimate of 1.6 million deliveries seems achievable. While he expects Q4 U.S. sales to dip materially after the end of EV tax credits, he expects this to be partially offset by a strong quarter in China. Yu expects Q4 volume to come in at around 409,000 units (between Q2 and Q3 levels), leading to just below 1.6 million units for the full year. He expects Q4 margin and EPS to be impacted by lower volume and potentially higher tariff costs.

Meanwhile, Yu thinks that CEO Elon Musk’s clear focus on Tesla’s key initiatives (robotaxi and Optimus humanoid robot) and the recent compensation package have removed a major overhang on TSLA stock. He believes that these two growth areas will allow Tesla to benefit from being a “leader in embodied AI.”

What Is the Prediction for Tesla Stock?

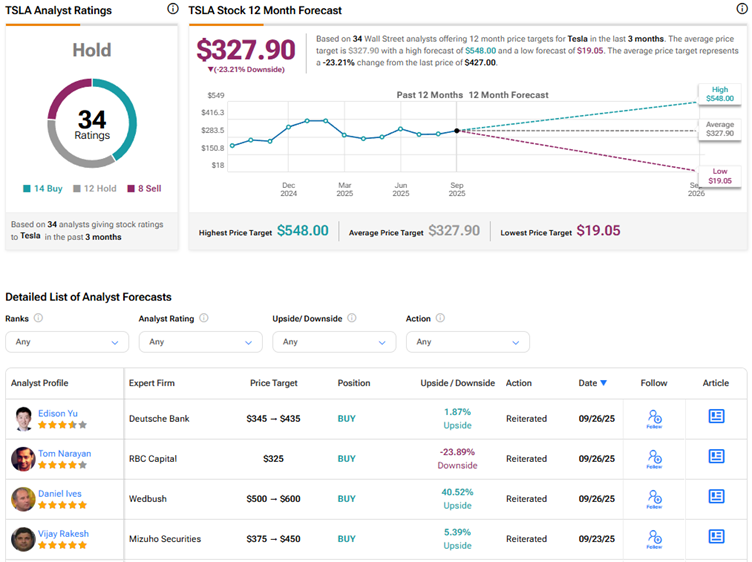

Amid concerns about intense competition in the EV space, Wall Street has a Hold consensus rating on Tesla stock based on 14 Buys, 12 Holds, and eight Sell recommendations. The average TSLA stock price target of $327.90 indicates a downside risk of 23.2% from current levels.