Shares of Nvidia (NVDA) are slightly up at the time of writing after 4.5-star Wedbush analyst Daniel Ives said that demand for the chipmaker’s Blackwell GPUs “is far outstripping supply.” This comment comes after the research firm spoke with multiple enterprise AI customers. Indeed, Ives said that “NOT ONE” of these companies showed any signs of slowing down or changing their AI investment plans despite the recent competition from DeepSeek.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As a result, Wedbush estimates that around 10% to 15% of IT budgets will be allocated to artificial intelligence in 2025. The analysts also expect capital expenditures from major companies to increase by $100 billion to $325 billion in 2025. This growth is being driven by IT departments that are focusing on building large-scale AI systems that use cloud services from Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL).

In addition, Wedbush analysts believe that the AI revolution will continue to increase demand for Nvidia’s GPUs and other AI-related technologies despite trade tensions with China. In fact, the analysts argue that DeepSeek has accelerated demand for AI solutions rather than slowing it down. Interestingly, this optimism is the opposite view that some tech bears have, who believe that DeepSeek’s impact on the AI market is more negative due to its supposedly lower-cost model.

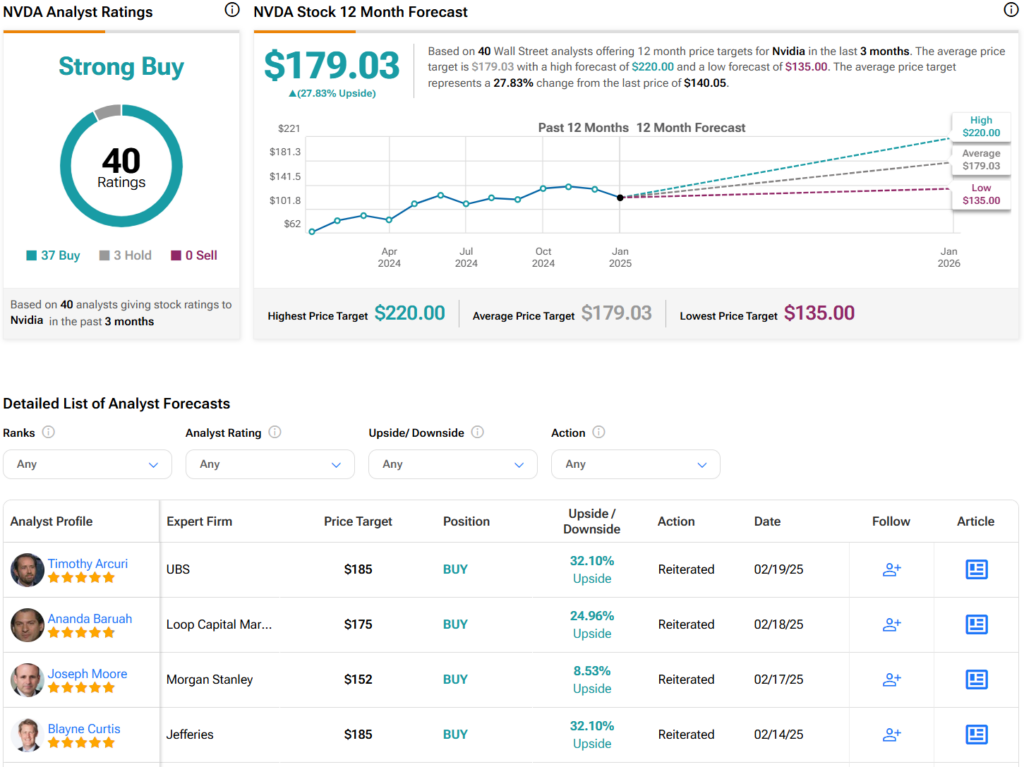

Is NVDA a Good Stock to Buy?

Overall, analysts remain bullish on NVDA stock, with a Strong Buy consensus rating based on 37 Buys and three Holds assigned in the past three months. After a 101% rally in its share price over the past year, the average NVDA price target of $179 per share implies an upside potential of 27.8% from current levels.