Shares of the airline, Delta Airlines (NYSE: DAL) inched up higher in pre-market trading on Thursday after an upbeat forecast as the airliner expects earnings in the fiscal second (June) quarter to be between $2 and $2.25 per share, higher than consensus forecasts of $1.64. For FY23, EPS is anticipated to be in the range of $5 to $6 versus consensus estimates of $5.37.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DAL has projected its revenues in the June quarter to grow in the range of 15% to 17% while they are projected to rise between 15% and 20% in FY23.

Ed Bastian, Delta’s CEO commented, “With solid March quarter profitability and a strong outlook for the June quarter, we are confident in our full-year guidance for revenue growth of 15 to 20 percent year over year, earnings of $5 to $6 per share and free cash flow of over $2 billion.”

In Q1, the airliner posted operating revenues of $12.8 billion, a jump of 36% year-over-year versus analysts’ estimates of around $12 billion. Adjusted earnings came in at $0.25 per share versus a loss of $1.23 in the same period last year but fell short of consensus estimates of $0.29 per share.

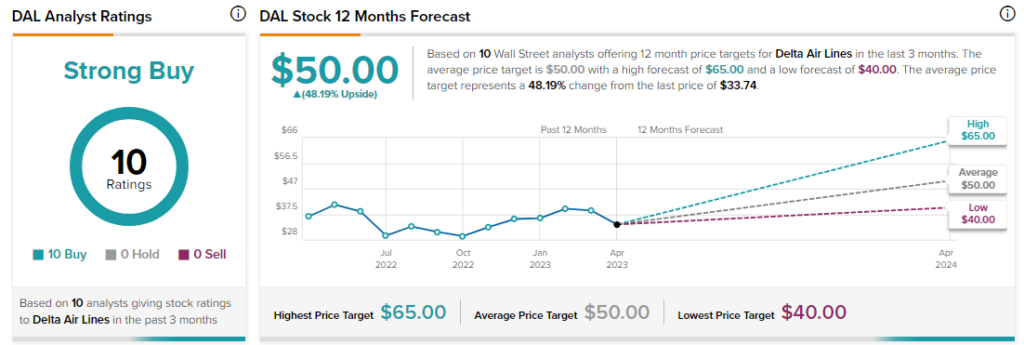

DAL stock scores a Strong Buy consensus rating from Wall Street analysts with 10 unanimous Buys.