Shares of a major airline, Delta Airlines (NYSE: DAL) swung up in pre-market trading on Thursday after the company reported Q3 adjusted earnings of $2.03 per share, up by 35% year-over-year and surpassing Street estimates of $1.95 per share. The airline posted adjusted operating revenues of $14.6 billion, increasing by 13% year-over-year and above analysts’ estimates of $14.55 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Delta stated that it has repaid $3.7 billion of debt year-to-date and it expects to repay more than $4 billion for the year. As a result, S&P upgraded DAL in August to BB+ “with a positive outlook.”

Looking forward, Glen Hauenstein, Delta’s President commented that he expects “robust demand for travel” to persist into the December quarter where revenues are expected to grow in the range of 9% to 12% year-over-year, while total revenue per available seat mile (TRASM) is estimated to decline between 2.5% and 4.5%.

Hauenstein added, “Within this outlook, Domestic and Transatlantic trends are consistent with the September quarter on a year-over-year basis, while unit revenue trends in the Pacific and Latin America are expected to modestly decelerate given capacity growth related to China re-opening and investment in our LATAM JV [joint venture].”

Delta has projected earnings per share in the range of $1.05 to $1.30 in Q4 while in FY23, it is likely to be between $6.00 and $6.25. In FY23, revenues are projected to rise by around 20% year-over-year.

Is Delta a Buy or Sell?

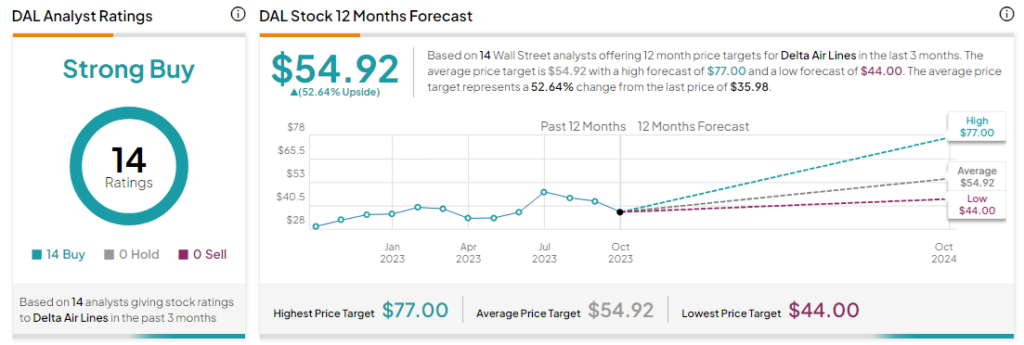

Analysts are bullish about DAL with a Strong Buy consensus rating based on a unanimous 14 Buys. They have an average DAL price target of $54.92, implying an upside potential of 52.6% at current levels.