Dell Technologies (DELL) reported its best-ever second-quarter results, topping both earnings and revenue estimates due to strong performances across all segments, driven by robust demand and execution.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Despite the Q2 beat, shares of the multinational technology giant were down 1.6% in Thursday’s extended trading session.

Adjusted earnings of $2.24 per share increased 17% year-over-year and beat analysts’ expectations of $2.03 per share. The company reported earnings of $1.92 per share in the prior-year period.

Additionally, revenues jumped 15% year-over-year to $26.12 billion and exceeded consensus estimates of $25.5 billion. (See Dell Technologies stock charts on TipRanks)

Segment-wise, Client Solutions Group revenue increased 27% to $14.3 billion driven by robust growth in the commercial client business. Also, Infrastructure Solutions Group revenue grew 3% to $8.4 billion as customers sped up their IT investments in multi-cloud solutions.

Markedly, VMware, slated for completion of its announced spin-off in early November, reported revenues that jumped 8% to $3.1 billion. This was attributed to overall strength spanning its diverse product portfolio.

For Q3, Dell expects above-normal sequential growth and mid- to high-teen year-over-year growth.

Dell’s CFO Tom Sweet commented, “We are creating long-term value by taking share, pursuing high-value growth opportunities and profitably growing and modernizing our core business. For example, in the storage space, VxRail orders were up 34% and PowerStore continues to ramp up nicely.”

Prior to the earnings results, Morgan Stanley analyst Kathryn Huberty reiterated a Buy rating on the stock.

Huberty predicted second-quarter results to outperform expectations based on a visible recovery in demand for enterprise storage products and corporate PCs as an increasing number of workers return to offices.

Consensus among analysts is a Moderate Buy based on 5 Buys and 2 Holds. The average Dell Technologies price target of $110.80 implies 9.1% upside potential to current levels.

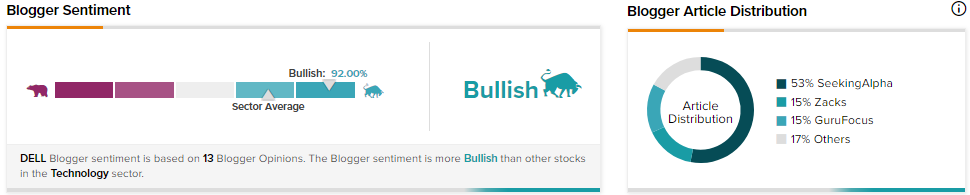

TipRanks data shows that financial blogger opinions are 92% Bullish on DELL, compared to a sector average of 71%.

Related News:

Ulta Beauty Leaps 5% on Stellar Q2 Results & Upbeat Guidance

Shoe Carnival Posts Record Q2 Results & Raises Guidance; Shares Down 6.4%

Kingsoft Cloud Holdings Posts Strong Q2 Revenues; Shares Surge 6%