Macroeconomics—the state of the larger economy of not only the United States but of the world—has not exactly been looking great lately. Those same pressures prompted Barclays to reduce their rating on Dell Technologies (NASDAQ:DELL), and the computer maker slumped accordingly in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Barclays analysts cut Dell’s rating from “equal weight” to “underweight,” citing those macroeconomic issues and their likely impact on people looking to buy desktop and laptop computers, Dell’s primary stock in trade. However, Barclays left the original price target of $53 intact. The general market for personal computers is somewhat slim, but there are signs of life as the “pull-forwards” from the COVID-19 pandemic are being lapped. Nevertheless, a slowdown is expected as Barclays looks for Dell’s revenues to fall 12% in Fiscal Year 2024.

Dell, for its part, is fighting this. And pretty hard, too; a range of deals have emerged, taking advantage of back-to-school shopping to push their PC lineup on parents looking to outfit their children for school. Further, Dell was also spotted offering some discounts for gamers, which is always a vital part of the overall PC market. An Alienware laptop recently took $800 off its price to draw gamers’ interest. Lower prices can be a way to beat at least some macroeconomic troubles; not everyone is outright bereft in a down economy. But most are instead watching their spending more closely, and bargain prices tend to overcome resistance.

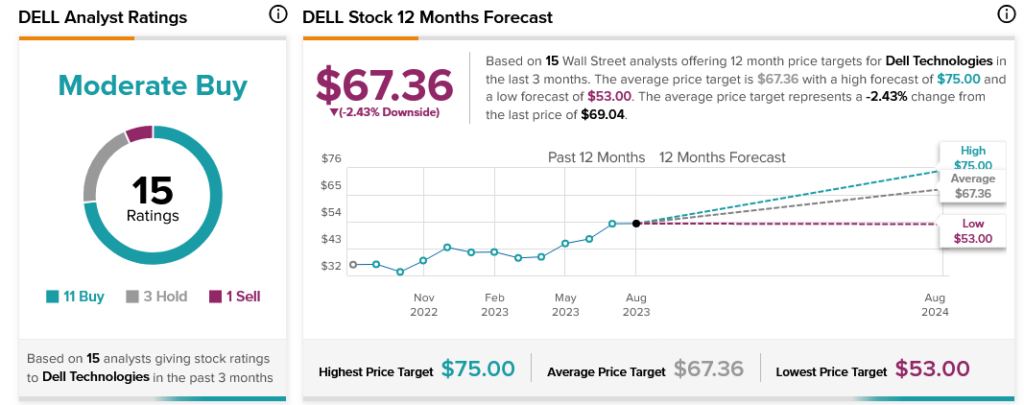

Turning to Wall Street, Dell stock is considered a Moderate Buy based on 11 Buy ratings, three Holds, and one Sell. However, with an average price target of $67.36, Dell stock comes with 2.43% downside risk.