Dell Technologies (NYSE:DELL) has long been known as a solid player in the home PC market. It’s also done nicely with businesses. And now, it may be able to get some benefit out of working in the AI space as well, as Daiwa Capital Markets recently pointed out in a note. That was enough to give Dell a boost, if only a fractional one, in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word from Daiwa, via analyst Louis Miscioscia, noted that AI sales are increasing while overall demand for technology is improving. Miscioscia augments this assertion by pointing out that the PowerEdge 9680 server from Dell has an order pipeline measuring $2 billion strong. AI servers, meanwhile, make up about 20% of those orders, showing that Dell has a fairly decent stake in the growing AI arms race. What’s more, Miscioscia looks for this to be the start of something great and even long-term, not just a temporary flash in the pan.

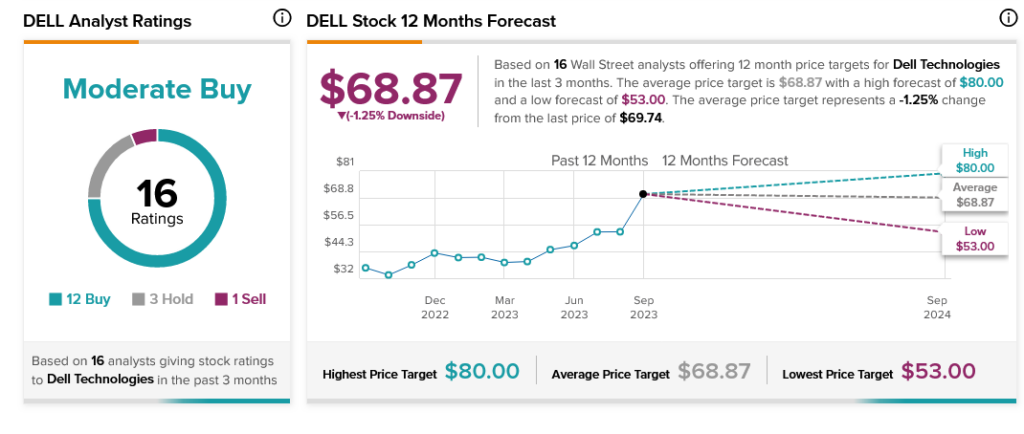

Is DELL a Buy or Sell?

Meanwhile, analysts are clearly on Dell’s side throughout the pool. With 12 Buy ratings, three Holds, and one Sell, Dell stock is a Moderate Buy by analyst consensus. However, with an average price target of $68.87, Dell stock also comes with 1.28% downside risk.