Dell Technologies (DELL) has reported mixed first-quarter financial results but raised its forward guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Texas-based company announced earnings per share (EPS) of $1.55, which fell short of the $1.69 forecast on Wall Street. Revenue in the period totaled $23.38 billion, which surpassed the $23.14 billion consensus forecast of analysts. Sales were up 5% from a year earlier.

In terms of guidance, Dell’s executive team said they expect $2.25 in earnings per share for the current quarter, with between $28.5 billion and $29.5 billion of revenue. That outlook is significantly higher than consensus expectations. Management attributed the strong guidance to $7 billion in artificial intelligence (AI) systems that are expected to ship during the quarter.

Dell’s balance sheet. Source: Main Street Data

Full-Year Outlook

For the full year, Dell expects $103 billion in revenue, which is in line with Wall Street forecasts. However, the company raised its forecast for full-year earnings to $9.40, which was a 10 cent increase from the company’s previous outlook.

Dell is one of chipmaker Nvidia’s (NVDA) main vendors for the servers that run AI processors. Dell said in its latest earnings statement that it is seeing “unprecedented demand” for AI servers and systems. Management said they have $14.4 billion in confirmed orders for AI systems in backlog that will ship in coming quarters. The company recorded $12.1 billion in AI orders during this year’s first quarter.

Segment Breakdown

Dell’s AI server business is reported as part of its Infrastructure Solutions Group, which had $10.3 billion in sales during the quarter, a 12% year-over-year increase. Of that, $6.3 billion was sales for servers and networking, and $4 billion was for computers that store data.

The company’s laptop and personal computer (PC) business, its Client Solutions Group, recorded $12.5 billion in sales as the global PC market begins to recover after slumping for several years. The computer maker spent $2.4 billion on share repurchases and dividends during the first quarter. DELL stock has declined 0.44% this year.

Is DELL Stock a Buy?

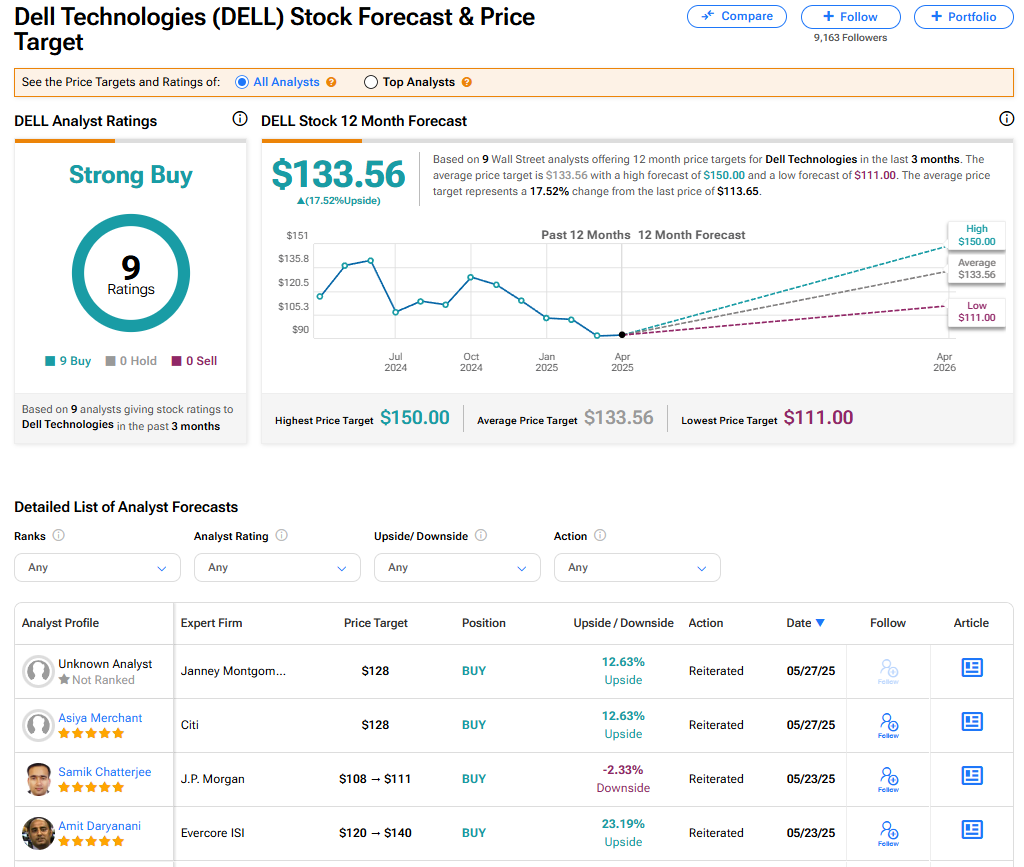

The stock of Dell Technologies has a consensus Strong Buy rating among nine Wall Street analysts. That rating is based on nine Buy recommendations issued in the last three months. The average DELL price target of $133.56 implies 17.52% upside from current levels. These ratings are likely to change after the company’s financial results.