Food delivery unicorn Deliveroo (GB:ROO) posted its third-quarter update today, with reduced sales expectations for the full year, as Britons cope with higher bills and cut down on takeaways.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Despite this, the company is targeting better earnings margin (EBITDA) guidance, driven by lower marketing and overhead costs.

The gross transaction value (GTV) increased by 8% on a year-on-year basis to £1.7 billion. Even though the total orders were down by 1%, the GTV per order was up by 9% due to higher prices on items.

Looking at the difficult consumer environment, the company now expects its GTV growth to be in the range of 4–8% instead of 4-12% as announced earlier.

The adjusted EBITDA margin is now expected to be in the range of 1.2-1.5%.

Victoria Scholar, the head of investment at Interactive Investor, said, “Deliveroo was very much a poster child stock of the stay-at-home pandemic trend in 2020, with supercharged demand for takeaways during lockdowns when restaurants and bars were forced to shut. However, the economic reopening and the cost-of-living crisis have dented demand for its non-essential offering.”

The update came two days after the company announced the closure of its operations in the Netherlands, along with a compensation package for the riders. The company took this action after it was unable to gain a decent share of the Dutch market.

The stock went up by almost 6% after the update and was trading up by 2.5% in the second half of the day. Overall, the stock has lost almost 60% of its value in this year.

Deliveroo’s share price forecast

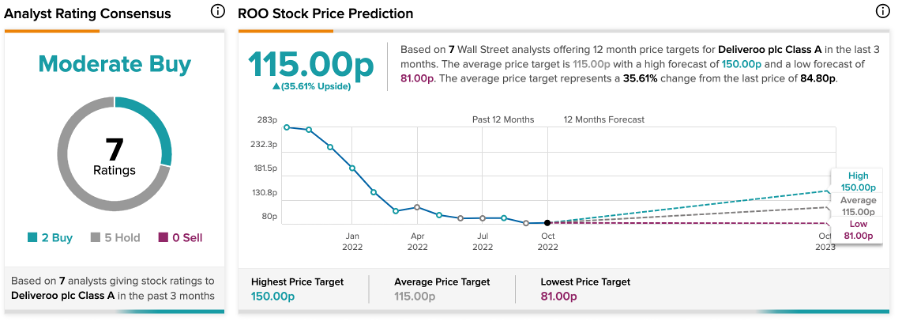

According to TipRanks’ analyst consensus, Deliveroo stock has a Moderate Buy rating.

The ROO target price is 115p, which shows an increase of 35.6% from the current price.

Conclusion

The UK-based food delivery company is another addition to the list of companies facing the heat of high inflation. As customers tighten their budgets, it’s difficult for companies to keep the sales momentum going.

However, Deliveroo remains confident in its ability to financially adapt to the tougher operating environment.