Shares of agricultural, construction and forestry machinery manufacturer Deere & Company (DE) fell 2.1% on Friday to close at $351.30 despite its better-than-expected results for the third quarter ended August 1, 2021. The robust results can be attributed to the growth witnessed in net revenues.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Quarterly net sales jumped 29% year-over-year to $11.53 billion, topping the Street’s estimate of $10.3 billion. A rise of 32% in net sales from Equipment Operations to $10.41 billion fueled this growth.

Production & Precision Agriculture, Small Agriculture & Turf and Construction & Forestry — the segments within Equipment Operations — reported a year-over-year net sales growth of 29%, 32% and 38%, respectively.

Meanwhile, quarterly earnings per share (EPS) of $5.32 was up 107% from the same period a year ago. The figure surpassed analysts estimate of $4.57 per share.

For 2021, the company anticipates its net sales to grow in the range of 25% to 30% for the Production & Precision Agriculture segment; above 25% for the Small Agriculture & Turf segment and above 30% for the Construction & Forestry segment.

The CEO of Deere & Co, John C. May, said, “Our strong results, driven by essentially all product categories, are a testament to the exceptional efforts of our employees and dealers to keep our factories running and customers served while enduring significant supply-chain pressures.” (See Deere & Co stock chart on TipRanks)

Recently, Robert W. Baird analyst Mircea Dobre reiterated a Buy rating on the stock with a price target of $425. The analyst’s price target implies upside potential of 20.9% from current levels.

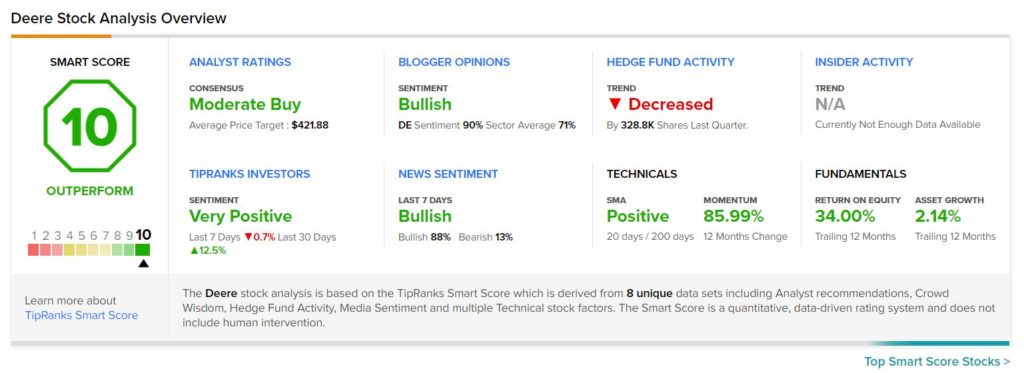

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 6 Buys, 2 Holds and 1 Sell. The average Deere & Co. price target of $421.88 implies that the stock has upside potential of 20.1% from current levels.

Deere & Co. scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained about 71.1% over the past year.

Related News:

Performance Food Reports Quarterly Beat; Shares Drop 4.2%

Petco Shares Jump on Q2 Beat, Lifts Guidance

Ross Stores Shares Fall 5% Despite Topping Q2 Expectations