Deckers Outdoor (DECK) stock plunged about 13% on Friday, as of writing, after the footwear and apparel company issued disappointing full-year sales guidance. The company’s weak outlook, which reflects the impact of tariffs and increased pricing, overshadowed its better-than-expected results for the second quarter of Fiscal 2026 (ended September 30, 2025).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Deckers’ Outlook Overshadows Better-Than-Expected Q2 Earnings

Deckers reported a 9.1% year-over-year growth in its Q2 FY26 net sales to $1.43 billion, modestly surpassing the Street’s estimate of $1.42 billion. The top-line growth was driven by strength in its HOKA and UGG brands in international markets. In fact, international sales rose 29.3% in the quarter, while domestic sales declined 1.7%. Coming to channel-wise performance, wholesale net sales grew 13.4%, partially offset by a 0.8% decline in the DTC (direct-to-consumer) net sales.

Meanwhile, Deckers reported a 14.5% year-over-year growth in its Q2 FY26 earnings per share (EPS) to $1.82, easily beating the consensus estimate of $1.58.

Looking ahead, management stated that U.S. consumers are a “little bit more cautious” and pulling back on discretionary purchases when they see price increases. Moreover, tariffs are expected to further hurt demand for DECK’s Hoka sneakers and UGG boots. While Deckers sources less than 5% of its products from China, it is significantly dependent on manufacturing in Vietnam, raising concerns about the impact of tariffs.

Overall, Deckers expects its Fiscal 2026 net sales to be about $5.35 billion. This estimate lags the Street’s top-line expectation of $5.46 billion.

Is Deck Stock a Good Buy?

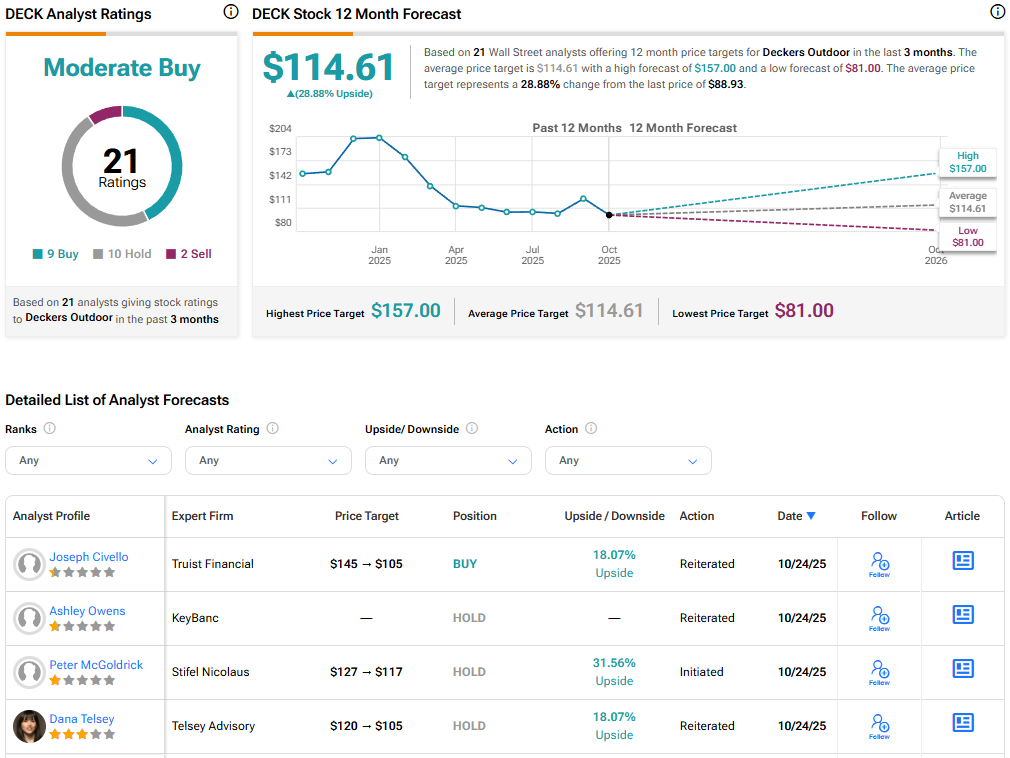

Following the Q2 print, Telsey Advisory analyst Dana Telsey lowered her price target for Deckers Outdoor stock to $105 from $120 and reiterated a Hold rating. Despite better-than-expected Q2 FY26 results, Tesley maintained a neutral stance due to softer implied guidance for the second half of FY26, lagging direct-to-consumer (DTC) business, and slowing HOKA growth.

Currently, Wall Street has a Moderate Buy consensus rating on Deckers Outdoor stock based on nine Buys, ten Holds, and two Sell recommendations. The average DECK stock price target of $114.61 indicates about 29% upside potential.

These ratings/price targets are expected to be revised as more analysts react to Q2 FY26 results and outlook.