Footwear, apparel, and accessories company Deckers Brands (NYSE:DECK) released stronger-than-expected Q4 financial results. Thanks to the solid Q4 beat, Deckers Outdoor stock jumped 8.11% in Thursday’s after-hours trading. What’s remarkable is that the business maintained its momentum despite macroeconomic uncertainty.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth noting that Deckers’ top line has grown at a CAGR of 19% over the past four years. Moreover, its EPS has more than tripled during the same period.

The company’s Q4 performance reflects ongoing momentum in its two footwear brands, HOKA and UGG. It’s worth mentioning that HOKA is giving tough competition to Nike (NYSE:NKE) through its new product launches. As HOKA continues to support growth at Deckers, let’s delve into the company’s Q4 performance.

Q4 Snapshot

Deckers delivered net sales of $959.8 million, up 21.2% year-over-year. The company’s top line surpassed analysts’ average estimate of $888.5 million. HOKA brand net sales increased 34% year-over-year to $533 million. Moreover, UGG’s net sales increased by 14.9% to $361.3 million.

Thanks to the higher sales and better product mix, its gross margin in the fourth quarter expanded by 620 basis points to 56.2%.

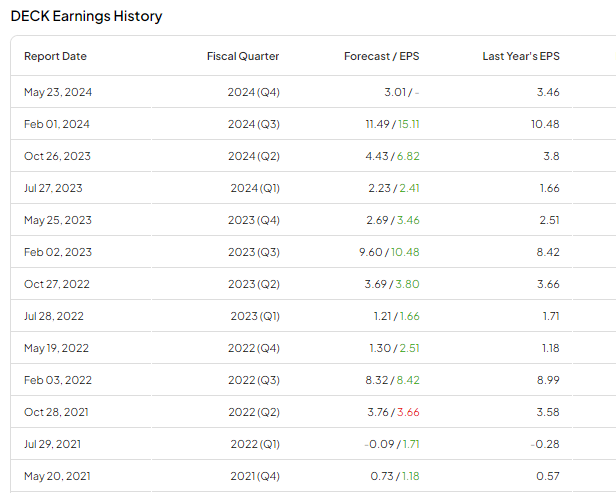

Leverage from higher sales, margin expansion, and a low outstanding share count significantly boosted Deckers Brands’ earnings. Deckers Brands reported earnings of $4.95 per share, up 43% year-over-year. Moreover, its EPS exceeded the Street’s forecast of $3.01. It’s worth noting that Deckers has beaten earnings estimates every quarter since the third quarter of Fiscal 2022.

Outlook

Looking forward, Deckers expects to report net sales of $4.7 billion in Fiscal 2025, up 10% year-over-year. Moreover, the company projects its earnings per share to be in the range of $29.50 to $30, which compares unfavorably with the analysts’ estimate of $30.74.

Is DECK a Good Stock to Buy?

Analysts are cautiously optimistic about DECK stock. It has seven Buy and six Hold recommendations for a Moderate Buy consensus rating.

DECK stock has gained over 35% year-to-date. Analysts’ average price target on DECK stock is $932.23, implying 3.05% upside potential from current levels.