The stock of Deere & Co. (DE) is up 5% after the farm equipment maker reported better-than-expected Fiscal second-quarter financial results and revised its guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Illinois-based Deere reported earnings per share (EPS) of $6.64, which was better than the $5.40 expected on Wall Street. Revenue from sales of the company’s agriculture and construction equipment totaled $11.1 billion, which was ahead of the $10.8 billion projected among analysts. However, sales were down 20% from $13.9 billion a year earlier.

In terms of guidance, Deere, which makes distinctive green and yellow John Deere tractors and mowers, said it expects Fiscal 2025 net income of $4.8 billion to $5.5 billion. That was down slightly from previous guidance that called for net income of $5 billion to $5.5 billion. The new guidance includes the likely impacts of tariffs, said management.

Deere is a net exporter and only imports a limited number of products, mostly from Mexico and Europe.

Deere & Co.’s net income. Source: Main Street Data

Farm Income

U.S. farm income in 2024 was $139 billion, down from $147 billion in 2023 and a record $182 billion in 2022. Less farm income typically means less Deere equipment purchased by farmers. The U.S. Department of Agriculture says that it expects a rebound this year, with farm income to reach $180 billion. That could prove to be a boon for Deere’s sales in coming months.

“Despite the near-term market challenges, we remain confident in the future,” said Deere CEO John May in the company’s news release. “Our commitment to delivering value for our customers includes ongoing investment in advanced products, solutions, and manufacturing capabilities.”

DE stock has risen 23% this year.

Is DE Stock a Buy?

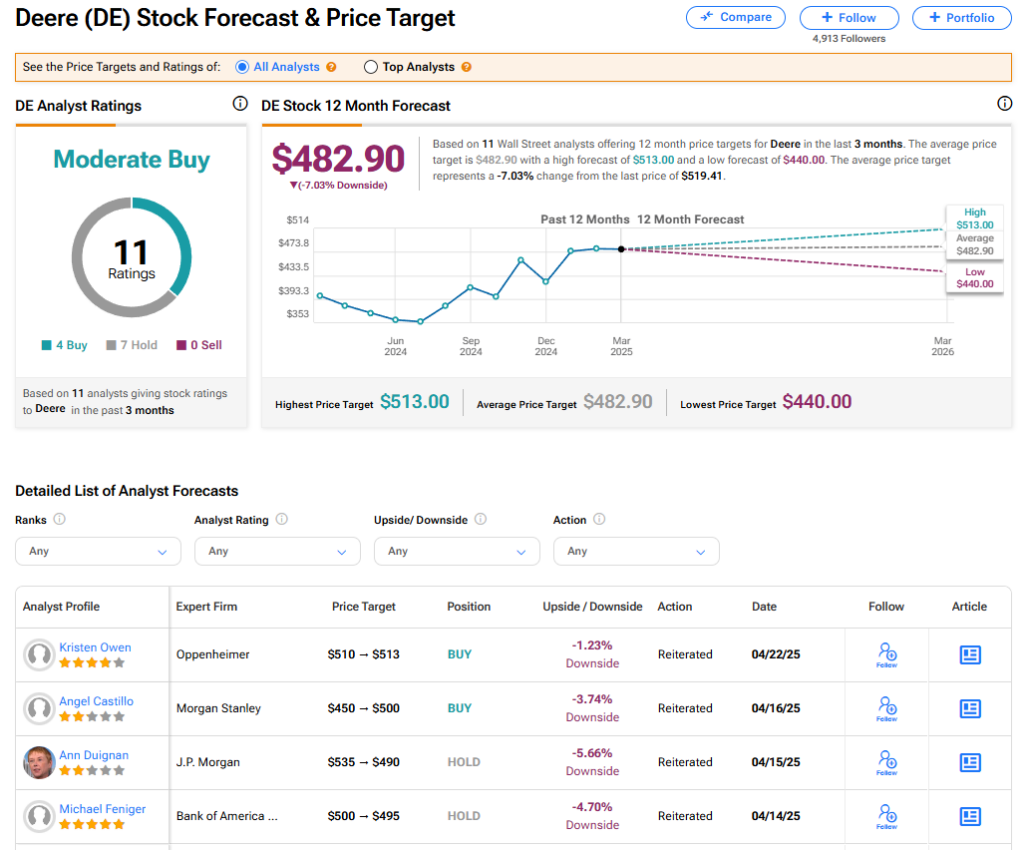

The stock of Deere & Co. has a consensus Moderate Buy rating among 11 Wall Street analysts. That rating is based on four Buy and seven Hold recommendations issued in the past three months. The average DE price target of $482.90 implies 7.03% downside risk from current levels. These ratings are likely to change after the company’s financial results.