Shares of Dave & Buster’s Entertainment tumbled over 26.1% on Thursday, after the Wall Street Journal reported that the company might have to file for bankruptcy if it fails to strike a deal with a lender.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, shares of the dining and entertainment company rose 4.8% in the extended trading session as Truist Financial said that investors are overreacting to the news.

According to the Wall Street Journal report, Dave & Buster’s (PLAY) is planning to layoff about 1,300 employees across seven US states in a move to cut costs.

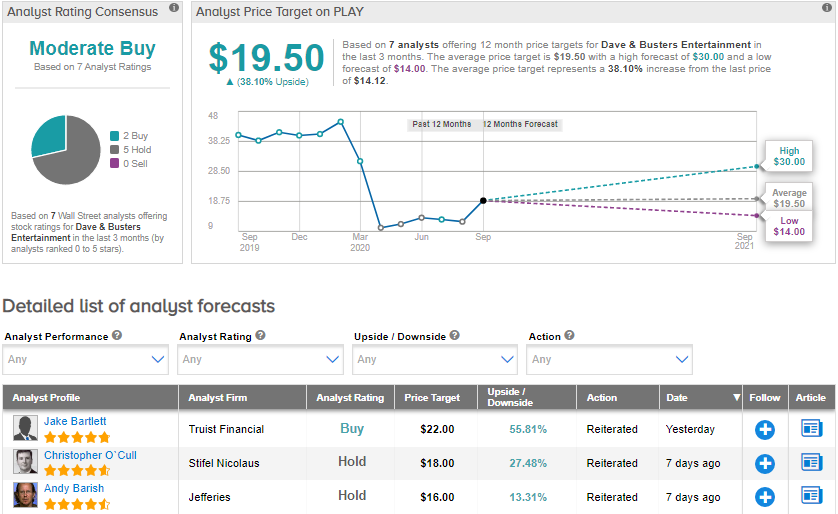

Truist Financial analyst Jake Bartlett called the share plunge during the regular trading session a “severe overreaction”. Bartlett said that the Wall Street Journal referred to the company’s disclosure made in its 2Q 10-Q filing that if it is not in compliance with debt covenants, it may file a voluntary petition for Chapter 11 bankruptcy.

Bartlett continues to believe that the company’s lenders will grant covenant relief, given recovering EBITDA of the company. The maintained a Buy rating on the stock with a price target of $22 (55.8% upside potential), saying that the pullback in the stock on the “unfounded” bankruptcy concerns acts as a buying opportunity.

Last week, the company reported 2Q revenues of $50.8 million, which missed analysts’ expectations of $80.9 million. Its top-line plunged 85% year-on-year, due to the coronavirus-driven shutdowns. (See PLAY stock analysis on TipRanks).

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 5 Holds. The average price target of $59.06 now implies upside potential of about 38.1% to current levels. Shares have declined 64.9% year-to-date.

Related News:

Dave & Buster’s Drops In After-Hours As Sales Plunge 85%

Whiting Petroleum Plans $20M In Cost Cuts, Provides 2H Guidance; Shares Rise

Oak Street Health Drops 5% in Pre-Market On Larger 2Q Loss