Exciting news landed for information technology stock Datadog (NASDAQ:DDOG) earlier today, thanks to some positive word from Wolfe Research. This caused shares to surge at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Just ahead of Datadog’s Dash conference—and, about a week after its second-quarter earnings report—Wolfe analysts pushed Datadog up from “peer perform” to “outperform,” and established a price target of $140 per share, a decent premium over where it’s trading even today. The upgrade came about not because of Datadog’s current valuation, but rather, because Wolfe reconsidered certain basic measures about Datadog’s performance. Early research suggested growth was on the decline, steered by several factors at once. However, the latest research shows that a slowdown did happen, but the valuation expanded as well.

Better yet, new reports note that Datadog software is proving increasingly vital to everyday engineering use. Wolfe Research’s Alex Zukin noted that “Even in a cost-cutting-obsessed macro environment, engineers simply cannot live without their Datadog.” That’s exactly the kind of thing any business wants to hear about its product. And just to round it out, Zukin also noted that Datadog has improved on several fronts, starting with go-to-market execution and taking on competitors.

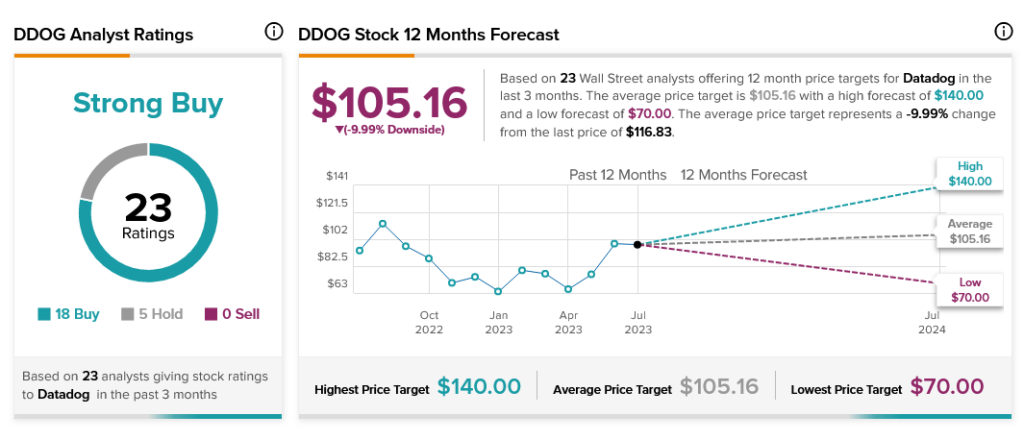

All these factors together show why analysts call Datadog a Strong Buy based on 18 Buy ratings and five Holds. However, Datadog may suffer under the weight of its own success. Currently, Datadog stock comes with 9.99% downside risk.