Databricks, which develops software that helps companies analyze data, has announced a major deal with Microsoft-backed (MSFT) AI firm OpenAI. Indeed, Databricks will invest $100 million over several years to integrate OpenAI’s AI models, such as GPT-5, into its platform. This move will make it much easier for Databricks customers to connect their data with OpenAI’s tools. Interestingly, this is the first time OpenAI has done a formal integration like this with a business-focused company, according to OpenAI’s COO Brad Lightcap.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, he said that the deal could bring in much more than $100 million in revenue down the line. This new collaboration stands out because of how simple it makes things for users. In the past, Databricks customers needed complicated tech setups and legal approvals to use OpenAI’s models. Now, with this partnership, they can start using GPT-5 and other models directly from the Databricks interface with just a click, and at the same price as accessing OpenAI directly.

Interestingly, other tech giants are also integrating AI. For instance, Snowflake (SNOW), which competes with Databricks, recently expanded its partnership with Microsoft to offer OpenAI models. Separately, Oracle (ORCL) will launch a service to run models from OpenAI, Google (GOOGL), and xAI using its own database software.

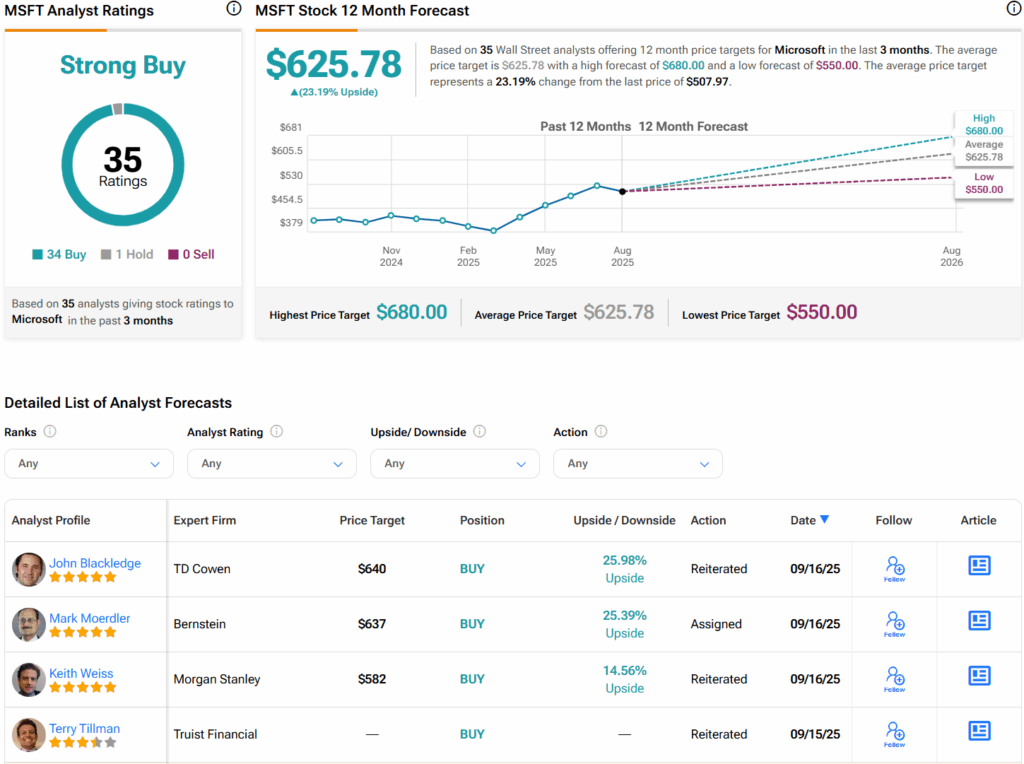

Is MSFT Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys and one Hold assigned in the last three months. In addition, the average MSFT price target of $625.78 per share implies 23.2% upside potential.