Nvidia’s (NASDAQ:NVDA) blockbuster Q1 earnings have fueled a rally in AI stocks. Besides Nvidia, companies making servers like Super Micro Computer (NASDAQ:SMCI), Dell (NYSE:DELL), and chipmaker TSMC (NYSE:TSM) were also trading higher in pre-market trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The rally in the above stocks has been fueled by Nvidia’s Q1 data center revenues, which skyrocketed by more than 400% year-over-year to a record $22.6 billion. The chip giant’s surging data center revenues put to rest concerns that companies’ spending on data centers could be slowing down.

A data center is a facility housing computer systems like servers and related components, including telecommunications and storage systems. Data centers are used to process, store, and manage large amounts of data and are a key component of AI.

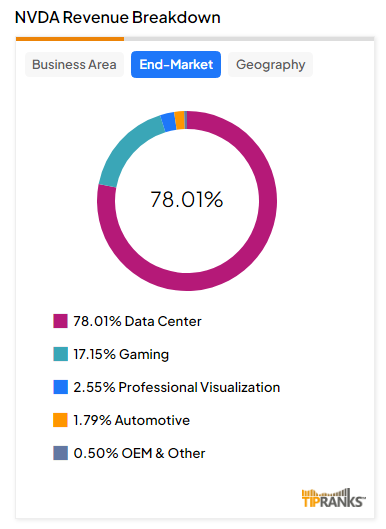

Data Centers – A Key End Market for Nvidia

Indeed, in the first quarter, data centers comprised more than 75% of Nvidia’s revenues of $26.04 billion, as indicated by the graphic below.

In an exclusive interview with Yahoo Finance following Nvidia’s Q1 results, Nvidia’s CEO, Jensen Huang, commented that the demand for the company’s data center Graphics Processing Units (GPUs) far outstripped supply. Furthermore, Huang stated that the demand for both its Blackwell and Hopper AI platforms will exceed supply into next year.

Nvidia’s Transition to AI Inference

Huang also discussed Nvidia’s transition from AI training to AI inferencing, where companies deploy AI models for customer use. Despite speculation that large-scale cloud providers like Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) might use their own chips for inferencing, Huang believes Nvidia’s offerings are equally powerful for both training and inference.

What Is the Target Price for NVDA?

Analysts remain bullish about NVDA stock, with a Strong Buy consensus rating based on 36 Buys and one Hold. Year-to-date, NVDA has surged by more than 90%, and the average NVDA price target of $1,104.62 implies an upside potential of 16.3% from current levels.