Shares of restaurant operator Darden Restaurants (NYSE:DRI) are in focus today after the company announced better-than-anticipated fourth-quarter numbers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenues rose 6.4% year-over-year to $2.8 billion, outperforming estimates by $30 million. EPS at $2.58 too landed past estimates by about $0.04. During the quarter, Darden saw a 4% uptick in blended same-restaurant sales alongside contributions from 47 net new outlets.

Nonetheless, shares of the company are on the decline today after Olive Garden, which contributes nearly half of its revenue delivered a tepid performance with same-store sales coming in at 4.4% versus the Street’s expectations of a 5% rise. Further, the company’s former CEO Eugene I. Lee, Jr. is stepping down as the Chairman of its Board of Directors.

Looking ahead, for fiscal 2024, Darden expects total sales to hover between $11.5 billion and $11.6 billion. EPS for the year is anticipated between $8.55 and $8.85. Additionally, the company also expects to open 50 net new restaurants during the year.

Darden has also boosted its quarterly dividend by 8% to $1.31 per share. The dividend is payable on August 1 to investors of record on July 10.

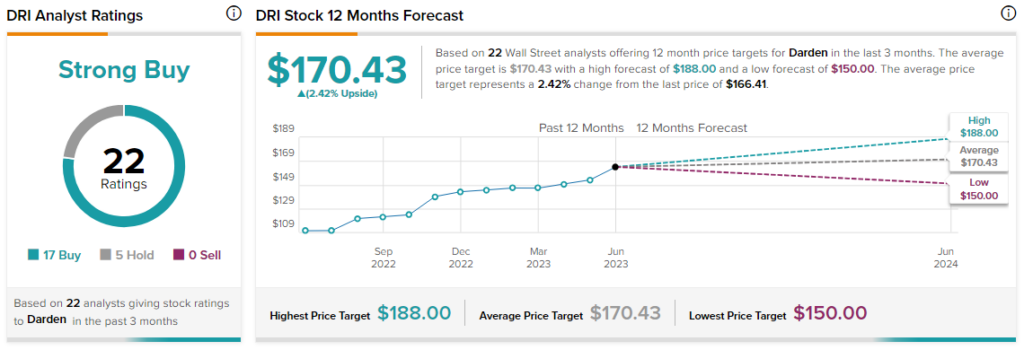

Overall, the Street has a $170.43 consensus price target on Darden alongside a Strong Buy consensus rating. Shares of the company have already gained nearly 46% over the past year.

Read full Disclosure