Wedbush analyst Daniel Ives said that Nvidia’s (NVDA) artificial intelligence (AI) chips are the “new oil or gold in this world for the tech ecosystem” and remains the only chip in the world fueling this AI Revolution. He expressed strong admiration for the technological advancements presented by CEO Jensen Huang at Nvidia’s annual GTC conference held in Washington yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

His views come despite the intensifying competition from Advanced Micro Devices (AMD) and Qualcomm (QCOM), which are also making significant strides in the sector. The conference fueled positive investor sentiment, sending Nvidia’s stock up nearly 5% and pushing its market valuation closer to $5 trillion for the first time.

Huang Is the ‘Godfather of AI,’ Says Ives

During the event, Huang shared updates on AI, robotics, quantum computing, and telecommunications, while reaffirming the company’s commitment to driving the future of AI. Ives noted that these updates reinforced Nvidia’s critical role in the tech ecosystem, powered by its advanced graphics processing units (GPUs).

He also highlighted Nvidia’s introduction of the Grace Blackwell NVL72 (GB200 NVL72) system, designed to improve its infrastructure by combining everything into one large rack. The platform aims to support more AI applications and deliver better results, including ten times higher performance, efficiency, and value at a much lower cost.

Importantly, Ives was impressed that Nvidia has a $500 billion revenue backlog from its Blackwell and Rubin chips by 2026, based on selling about 20 million GPUs. This figure is roughly ten times more than what its previous Hopper chips generated. The Rubin chips are expected to start production around this time next year. Nvidia also launched the Omniverse DSX Blueprint, a detailed plan to help build and run “Gigascale AI” factories more efficiently.

Is NVDA a Good Stock to Buy Now?

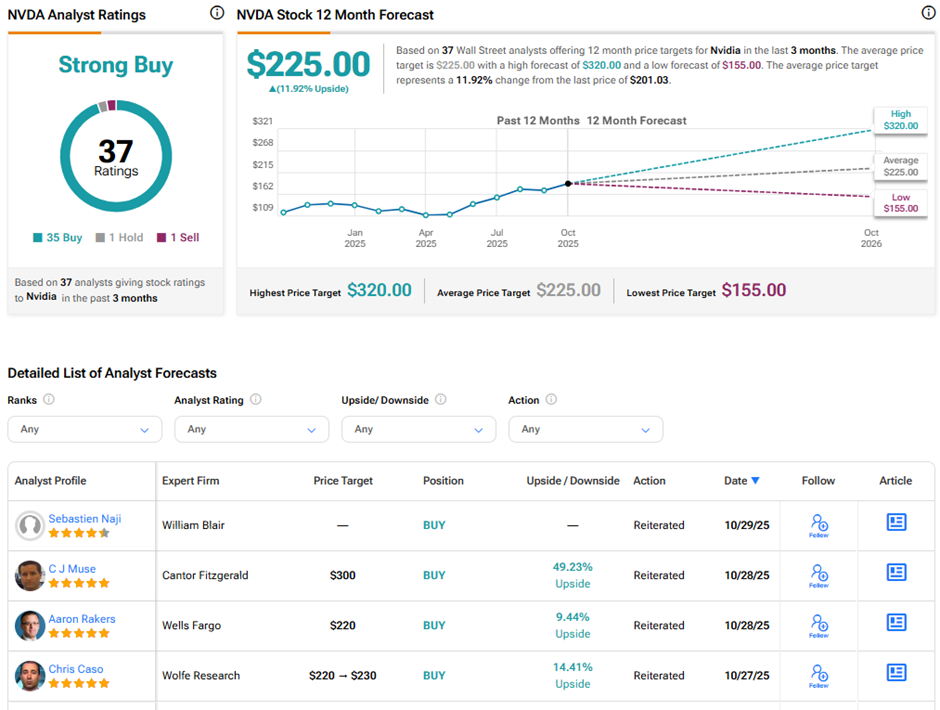

Analysts remain highly optimistic about Nvidia’s long-term outlook. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 35 Buys, one Hold, and one Sell rating. The average Nvidia price target of $225 implies nearly 12% upside potential from current levels. Year-to-date, NVDA stock has gained nearly 50%.