Shares of Microsoft (NASDAQ:MSFT) are lower today despite some positive commentary from analyst Dan Ives of Wedbush Securities. Indeed, Ives raised his price target to $290 per share while maintaining a Buy rating. For reference, his previous price target was $280 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Ives noted that cloud enterprise spending has stabilized following the softness seen in December. In addition, Microsoft’s Azure is in a good position to capture more market share, given the fact that most workloads have not been shifted to the cloud yet. This presents an important catalyst for the firm as customers continue making the shift to the cloud an IT priority.

Lastly, Ives also expects the widely followed acquisition of Activision-Blizzard (NASDAQ:ATVI) to close this summer, which would significantly boost Microsoft’s presence in the video game market.

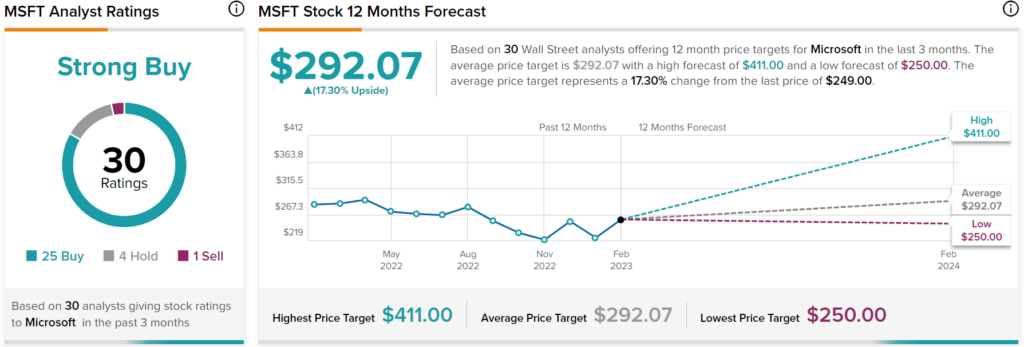

Overall, Wall Street analysts have a consensus price target of $292.07 on MSFT stock, implying 17.3% upside potential, as indicated by the graphic above.