With a holiday weekend approaching in the United States and legions of travelers planning to board flights to a host of places, Delta Air Lines (NYSE:DAL) is making headway in Wednesday afternoon’s trading. The tailwind giving Delta a little extra loft came from a new report out of Morgan Stanley, which had great things to say about the airline stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Morgan Stanley, via analyst Ravi Shanker, declared Delta to be its top pick in the entire airline sector, largely thanks to Delta’s recent Investor Day event. That’s a pretty big step, so a look at what went into that declaration should yield some exciting information. Shanker pointed out that Delta—based on what he saw at the event—is well on its way back to getting operational reliability back up and running. Its financial metrics are improving, and it’s entirely possible that it could reach pre-pandemic levels again fairly soon. In fact, all-time highs aren’t out of line based on what Shanker saw.

Yet there are clear signs that all is not well in the entire airline space, let alone for Delta. A rising mass of flight delays is already cropping up, mostly from major airports like LaGuardia and Newark. While it hasn’t risen to the level of a complete disaster just yet, there are significant issues all the same, as some of the delays are reaching multi-hour levels. The causes of these delays are mostly weather-related right now; a series of thunderstorms struck the East Coast of the U.S., and that left a lot of planes struggling. Already, terrifying stories have emerged of missed flights, misrouted luggage, and unaccompanied minors.

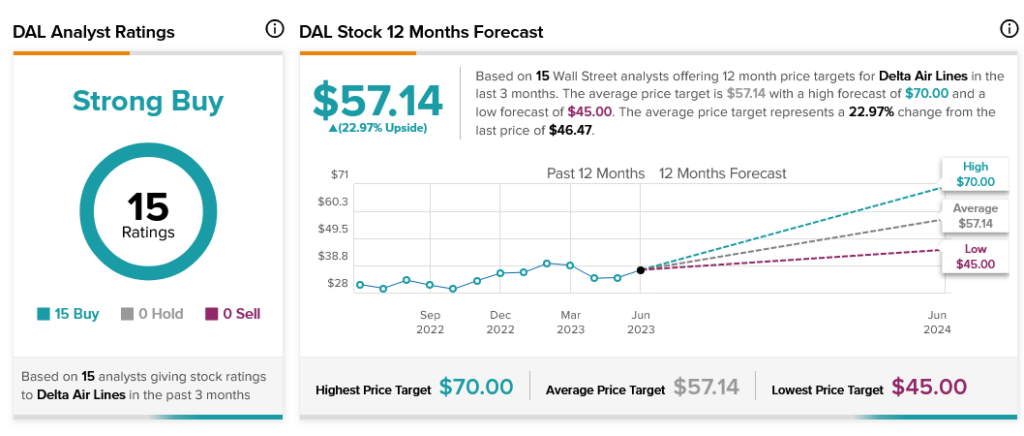

Analysts, however, couldn’t be less fazed. With 15 Buy ratings, it’s unanimous: DAL stock is a Strong Buy. Further, with an average price target of $57.14 per share, Delta Air Lines stock comes with 22.97% upside potential.