Daimler Truck Holding (DE:DTG) has consistently increased its unit sales in 2022 despite supply-chain challenges. Furthermore, the strong performance in the core market has led to continued momentum into 2023, prompting management to increase its full-year revenue guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Daimler Truck’s Chairman Martin Daum said that the company is performing well. Further, he announced a share buyback program of up to €2 billion. He added that the company is on track to deliver on its 2030 ambitions, including a “12% adjusted return on sales for the Industrial Business in sunny conditions.”

Q2 Deliveries Impress

As the company’s business is doing well, the leading commercial vehicle manufacturer sold 131,888 units worldwide in Q2. This reflects a 9% increase over the prior-year quarter.

Daimler Truck expects the momentum in its business to sustain in 2023, reflecting strong core markets, an improving supply chain, and robust pricing. Also, a strong development of the services business will support its financial performance in 2023.

Given the favorable operating environment, Daimler increased its 2023 group revenue guidance to €56 billion and €58 billion, compared to its previous outlook of €55 billion and €57 billion.

Daimler Targets Stable Dividend Payouts

Daimler is focusing on reducing its fixed costs and capital expenditures. Further, it plans on increasing its service revenues. This will add more resilience to its business and lower the impact of cyclical downturns in the industry.

The company remains confident in generating strong free cash flows and has updated its capital allocation policy to make its dividend payments stable even in more challenging market environments. Daimler Truck highlighted that it targets a dividend payout range of 40-60% in the future, which is sustainable.

Is Daimler Truck Stock a Buy?

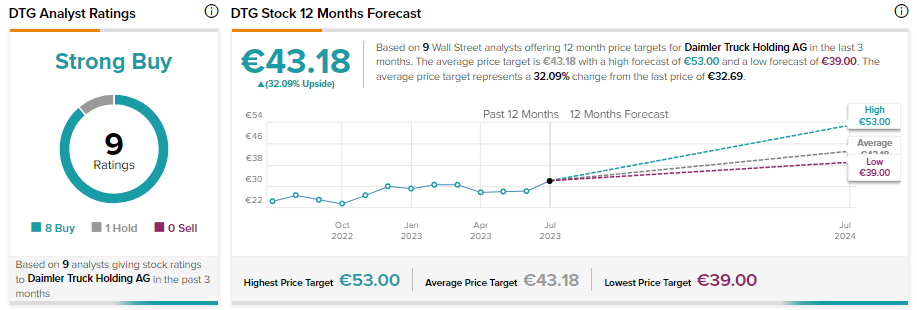

Thanks to the strength of its business, analysts maintain a favorable outlook on Daimler Truck stock. DTG stock sports a Strong Buy consensus rating on TipRanks based on eight Buy and one Hold recommendations. The average price prediction for a 12-month period is €43.18, which implies a 32.09% growth from the current price.