D-Wave Quantum (NYSE:QBTS) was having a rough run in 2025, with its stock deep in the red year-to-date – until everything flipped last Thursday. Shares of the quantum computing specialist surged over 50%, as investors applauded its Q1 readout.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company recognized revenue from its first-ever sale of the Advantage system, a milestone CEO Dr. Alan Baratz hailed as a defining moment for the company. The transaction drove gross margin up to 93.6%, a significant jump from 73% in the prior quarter. Quarterly revenue surged to $15 million, up 507% year-over-year, and beat Wall Street expectations by $4.5 million. That momentum carried through to the bottom line, with EPS landing at -$0.02, ahead of analysts’ forecasts by $0.03.

The quarter also featured several other notable developments. The biggest involved a demonstration of quantum supremacy – the ability of a quantum computer to solve a problem beyond the practical reach of classical supercomputers – on a real-world magnetic simulation problem using its 1,200-qubit Advantage2 prototype system. The next-gen quantum annealer generated a solution substantially faster than possible on the leading supercomputer, Frontier, while using significantly less energy than traditional computing methods. This work was subsequently published in a peer-reviewed Science article in March. Management also confirmed that the Advantage2 system remains on track for general availability by the end of Q2.

Furthermore, D-Wave released a research study exploring the use of quantum-powered blockchain hashing, incorporating a quantum proof-of-work approach to improve both security and efficiency. The study marked the first demonstration of distributed quantum computing, involving the simultaneous use of four quantum systems. The company said the publication has sparked strong interest across the blockchain industry, with many promising applications already identified.

Benchmark analyst David Williams, ranked in the top 3% of Wall Street experts, was impressed by the quarter’s breadth of achievements, noting: “While each had been previously disclosed, we think the progress demonstrates the strength of the firm’s technology, accelerating pace of adoption, and improving pipeline of revenue generating opportunities. Overall, we believe this quarter was a validation of the company’s annealing approach, advancing technology roadmap, growing customer interest and commercial adoption momentum.”

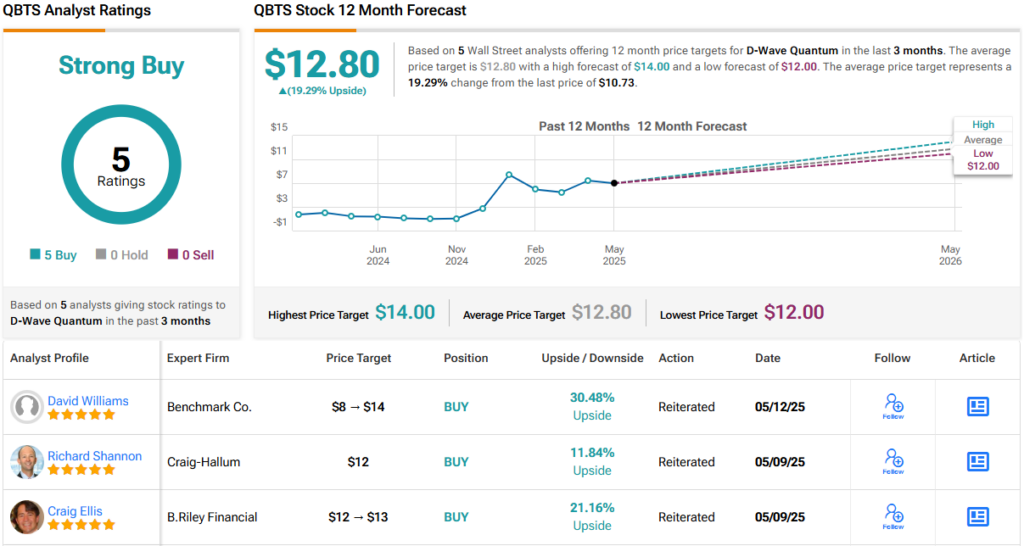

To this end, Williams rates QBTS shares a Buy, while raising his price target from $8 to $14, suggesting the stock will climb 30% higher in the months ahead. (To watch Williams’ track record, click here)

Overall, D-Wave gets a full house of Buys from the analyst community – 5, in total – all naturally coalescing to a Strong Buy consensus rating. The $12.80 average price target points towards one-year gains of 19%. (See QBTS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.