D-Wave Quantum (QBTS) just delivered what its CEO, Dr. Alan Baratz, called “arguably the most significant quarter in the company’s history,” and investors are clearly paying attention. Following strong financial results and a groundbreaking quantum computing milestone, the stock jumped more than 14% this week. With momentum building across its commercial business and technological roadmap, D-Wave’s latest earnings call marked a turning point that could signal the company’s move from experimental to essential in the race for quantum dominance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Financial and Technological Breakthroughs

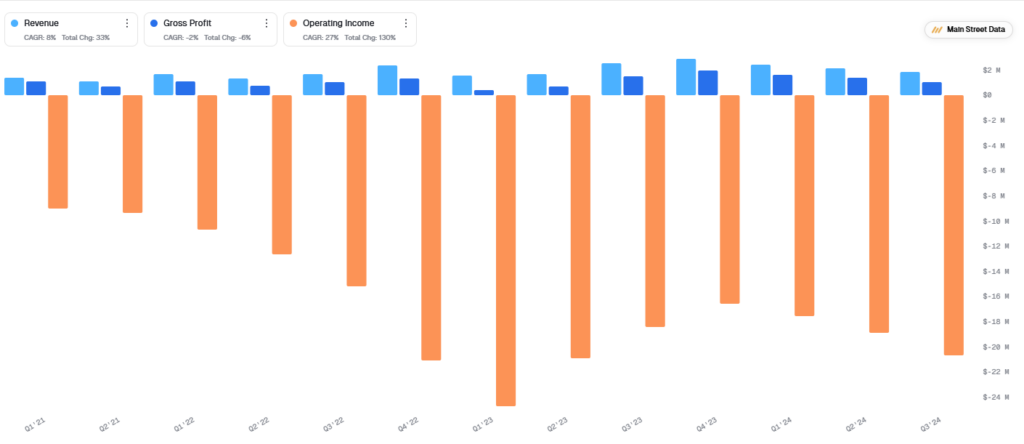

The numbers alone are eye-catching. Revenue soared to $15 million, up 507% year-over-year, fueled by the company’s first-ever sale of its Advantage quantum computer system. Not only did this mark a significant commercial milestone, but it also drove an impressive 93.6% gross margin, signaling strong operational efficiency. At the same time, D-Wave narrowed its net loss to $5.4 million, a big improvement from the $17.3 million loss posted a year ago. These results point to growing momentum in both customer adoption and financial performance.

However, it wasn’t just the earnings that sparked investor enthusiasm. D-Wave also announced a landmark achievement in the quantum space. Using its new 1,200-qubit Advantage2 prototype, the company demonstrated quantum supremacy—solving a real-world materials simulation problem that would have taken a classical supercomputer millions of years to complete. This accomplishment has been hailed as a turning point, showing that quantum computing is no longer a theoretical goal but an applied technology with tangible results.

Adding to the buzz, D-Wave introduced a quantum-powered blockchain hashing system. Using the same quantum techniques from its supremacy demonstration, this system can reduce energy usage in blockchain operations by up to 1,000 times compared to traditional methods. It’s an industry first and one that positions D-Wave at the intersection of two fast-moving tech frontiers: quantum computing and blockchain.

Strong Sentiment

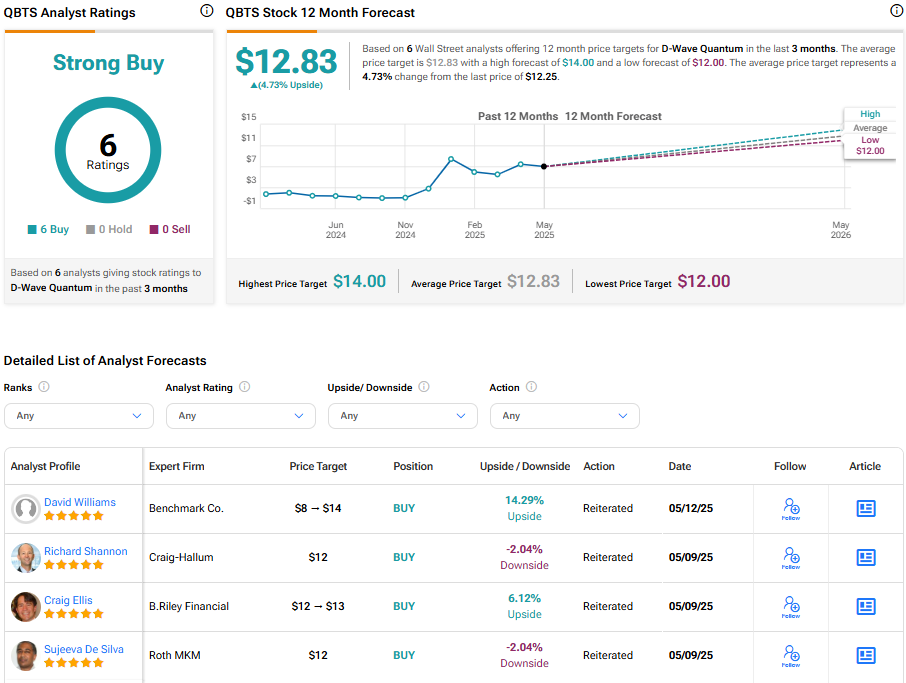

Unsurprisingly, analysts have responded with growing optimism. Benchmark top analyst David Williams raised his price target on QBTS from $8 to $14, calling this “one of the most significant quarters” in the company’s history. Overall, TipRanks data shows a Strong Buy consensus, with all tracked analysts issuing bullish ratings.

With a record cash position of over $300 million, a proven commercial product, and a headline-making scientific breakthrough, D-Wave is beginning to look less like a speculative bet and more like a serious player in a sector poised for explosive growth.

QBTS may be worth a closer look for investors eyeing the quantum revolution—before the rest of the market catches up.

Is QBTS a Good Stock to Buy?

Analyst consensus signals a Strong Buy, and after last quarter’s impressive earnings call, analysts have doubled down on their bullish sentiment with the price target on the rise. The average QBTS stock price target is $12.83, implying a 4.73% upside potential.