D-Wave Quantum (QBTS) is drawing attention before its earnings release as it reports progress in a new project with BASF (BASFY), a global chemical company. The two firms completed a proof-of-concept that utilized D-Wave’s hybrid quantum system to enhance a manufacturing process. The system cut scheduling time in a liquid-filling plant from about 10 hours to just five seconds. It also reduced lateness by 14%, setup time by 9%, and tank unloading time by 18%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This project shows how D-Wave’s technology can speed up real-world operations. By combining quantum and classical computing, the company aims to help clients handle complex industrial problems faster. While the project is still a test case, it may open doors for more deals in manufacturing and supply chain management.

Earnings and Market Outlook

In other news, D-Wave Quantum is scheduled to report its third-quarter earnings today before the market opens. Wall Street expects the company to post a loss of $0.07 per share and revenue of around $3 million. The firm last reported quarterly revenue of about $3.1 million, which was up 42% from the year before. Analysts will likely watch for any new customer updates or signs that early projects are turning into longer-term contracts.

At the same time, the company has raised extra funds through stock offerings to extend its cash runway. Investors will want to see if that money supports growth and helps move toward steady revenue. D-Wave has also expanded its reach by making its newest Advantage2 quantum system available to clients worldwide through its Leap cloud platform.

A Market Still in Early Stages

Quantum computing remains a young field, and companies like D-Wave are still in the early stages of adoption. Stock movement in this space can be sharp as the market weighs future promise against current results. Shares of D-Wave have risen more than 70% in the past three months, showing strong interest from traders. The recent project with BASF gives D-Wave a timely story to tell, but the numbers released today will show how much that progress translates into its financial picture.

Is QBTS a Good Stock to Buy?

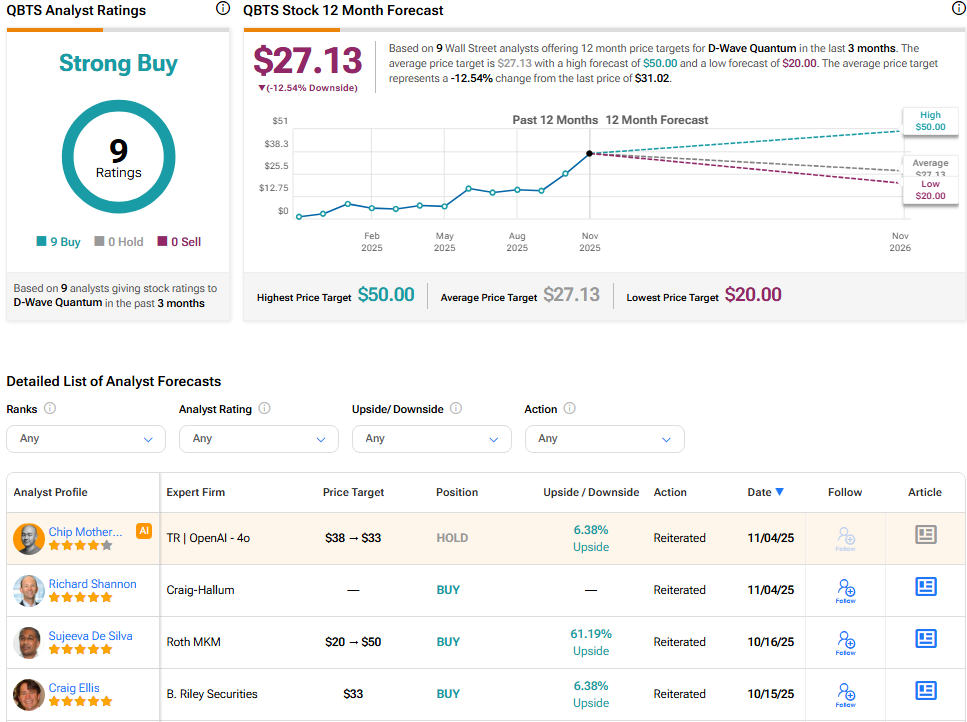

D-Wave continues to enjoy the Street’s analysts’ backing with a Strong Buy consensus rating. The average QBTS stock price target stands at $27.13, implying a 12.54% downside from the current price.