The one good thing about being a cybersecurity stock, at least these days, should be that there’s always a fairly brisk demand for your product. That isn’t always the case, though, as a range of cybersecurity stocks found out in Monday’s trading session after word emerged from Morgan Stanley about what’s going on in the field right now.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

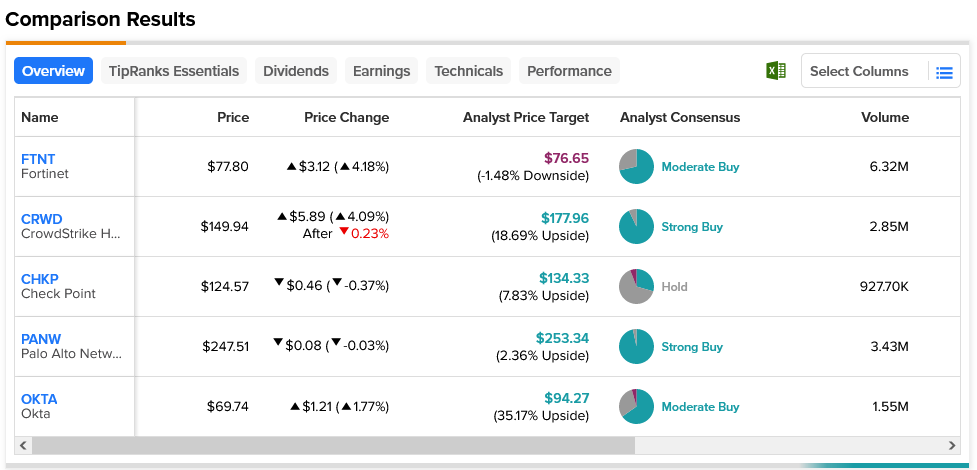

The word from Morgan Stanley analyst Hamza Fodderwala noted, much as outsiders would expect, that some stocks were in a better position than others, despite what should be a brisk market overall. Fodderwalla pointed to several stocks in particular—CrowdStrike (NASDAQ:CRWD), Check Point Software (NASDAQ:CHKP), Fortinet (NASDAQ:FTNT), and Palo Alto Networks (NASDAQ:PANW)—as likely winners despite a “challenging” quarter ahead for cybersecurity firms. Also mentioned was Okta (NASDAQ:OKTA), which will likely see a rougher time of things thanks to mixed results so far.

The first half will be particularly troublesome, notes Fodderwala, but the second half will likely improve as “pent-up demand” and “budget flush” come into play. Many businesses are likely deciding that upgrading their cybersecurity setups can wait a few months, though not much longer than that. And even among the likely potential winners, there are issues. For instance, the FortiOS remote code execution (RCE) vulnerability could hit as many as 300,000 Fortinet firewalls already in place. It’s a direct threat to the primary operating system itself, which means the vulnerabilities could be widespread.

Despite this, Fortinet was actually the second-highest gainer in Monday’s trading session, though it has the worst outlook. Fortinet is considered a Moderate Buy by analysts but has 1.48% downside risk thanks to its average price target of $76.65. Meanwhile, Okta—also a Moderate Buy—has an average price target of $94.27, giving it a hefty upside potential of 35.17%.