Shares of health services provider CVS Health (NYSE:CVS) are tanking at the time of publishing today after the company’s financial outlook disappointed investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company posted better-than-expected first-quarter numbers with revenue rising 11% year-over-year to $85.3 billion. The figure was ahead of estimates by $4.63 billion.

EPS at $2.20 too comfortably surpassed estimates by $0.11. While the rise in revenue came on the back of gains across all segments, CVS’ full-year 2023 outlook disappointed investors.

For the year, CVS expects EPS to hover between $8.50 and $8.70. This is a significant downward revision from the earlier range between $8.70 and $8.90. Cash flow from operations is anticipated between $12.5 billion and $13.5 billion for the period.

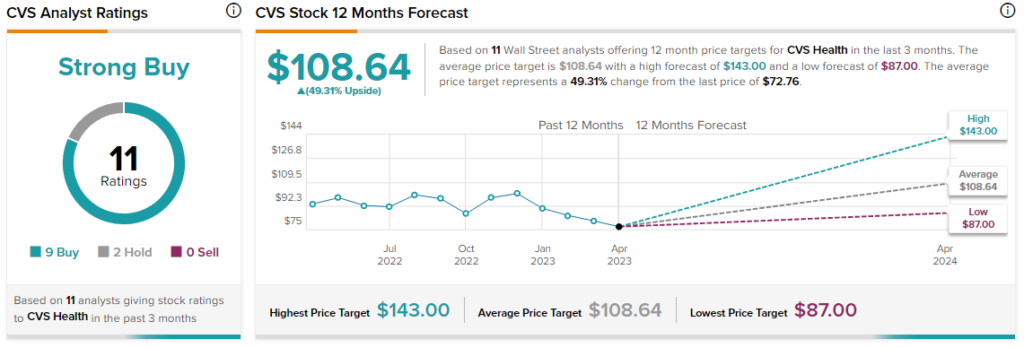

Overall, the Street has a $108.64 consensus price target on CVS, implying a potential upside of 49.3% in the stock. That’s after a 21.7% slide in CVS shares so far this year.

Read full Disclosure