CVS Health (NYSE:CVS) plans to close select pharmacies operating within Target (NYSE:TGT) stores to streamline its retail footprint and bolster financial performance. Additionally, the strategic move comes in response to softening demand post-pandemic, rising costs, and labor issues impacting the performance of the retail pharmacy chain.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The closing of pharmacies will be implemented between February and April of this year. Changes in population density, shifts in consumer purchasing patterns for pharmacy services, and anticipated future healthcare needs within local communities were considered in selecting the pharmacies to be closed.

The store closures are a part of CVS’s ongoing strategic initiative to optimize its retail footprint, with an aim to shutter 900 locations between 2022 and 2024. Notably, the company closed 600 locations by the end of 2023. Furthermore, CVS announced plans to eliminate 5,000 non-customer-facing positions in August 2023 as it struggled with high costs in its pharmacy and insurance businesses.

Is CVS a Buy or Sell?

Through its strategic acquisitions of Signify Health and Oak Street Health, CVS has expanded its capabilities and reach, paving the way for future growth. Also, its cost control measures bode well for long-term growth. Additionally, CVS’ impressive capital deployment activities and a dividend yield of 3% help instill confidence in the stock.

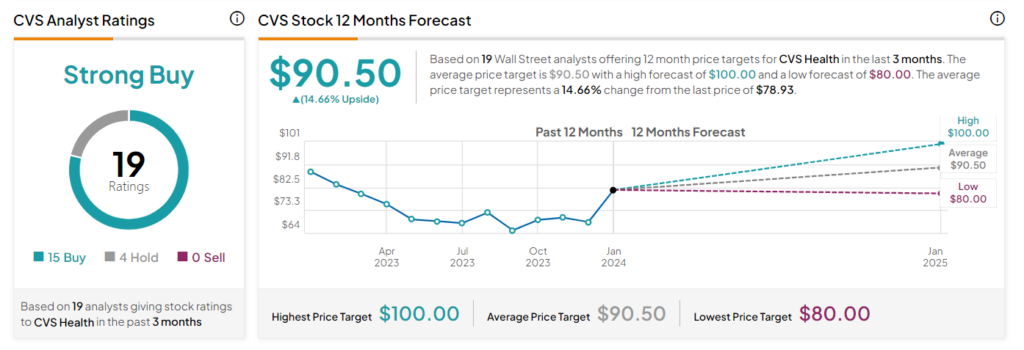

Of the 19 analysts covering CVS Health, 15 have a Buy rating and four suggest a Hold. Overall, the stock comes in as a Strong Buy. The average CVS stock price target is $90.50, implying 14.7% upside potential. Shares are up 13.9% over the past six months.