CVS Health (NYSE:CVS) will report its Q4 earnings for 2022 on February 8 before the market opens. Analysts expect a slight decline in revenues and earnings in the upcoming fourth quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CVS Health is a healthcare solutions company that provides a complete range of services, from pharmacy to insurance.

For Q4 2022, analysts expect EPS to fall by 3% year-over-year to $1.92 and revenues to decrease by 6% to $76.3 billion. CVS Health’s overall performance is expected to be hit by rising costs.

On the plus side, the company is likely to benefit from its increased medical membership. Also, the company’s efforts to enhance its retail portfolio are expected to support the results in Q4.

For the full year 2022, adjusted EPS is expected to be in the range of $8.55 to $8.65.

CVS’s stock has lost around 20% in the last year.

Is CVS Stock a Good Buy Now?

Despite the slight decline expected in earnings, analysts have a bullish view of the stock. Recently, Ivan Feinseth from Tigress Financial reiterated his Buy rating on the stock and sees an upside of more than 50% in the stock price.

Feinseth believes the company’s upcoming acquisition of Signify Health and its new store formats, MinuteClinics, and HealthHUBs, will act as the “key growth catalyst,” driving more customers and pushing the top line.

CVS is expected to close the acquisition of Signify Health in the first half of 2023. The Wall Street Journal reported that the company appears to be nearing an agreement to acquire Oak Street Health (NYSE:OSH) for $10.5 billion. With these two acquisitions, the company would further deepen its presence in primary healthcare.

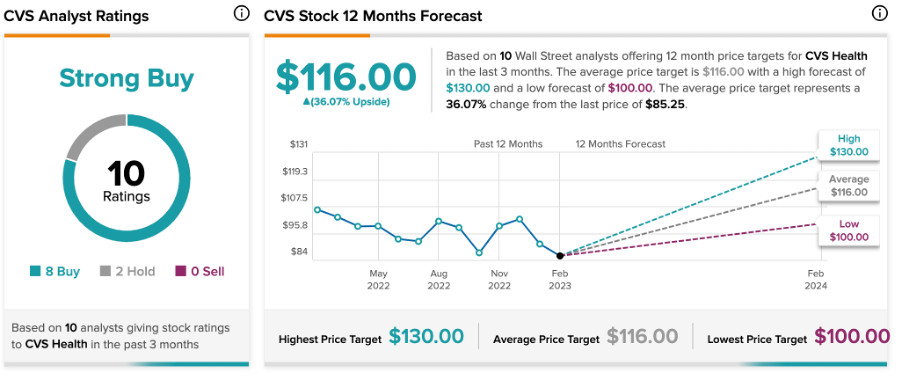

On TipRanks, CVS stock has a Moderate Buy rating, based on a total of 10 recommendations.

The average target price of $116 implies an upside potential of 36% on the current trading price.