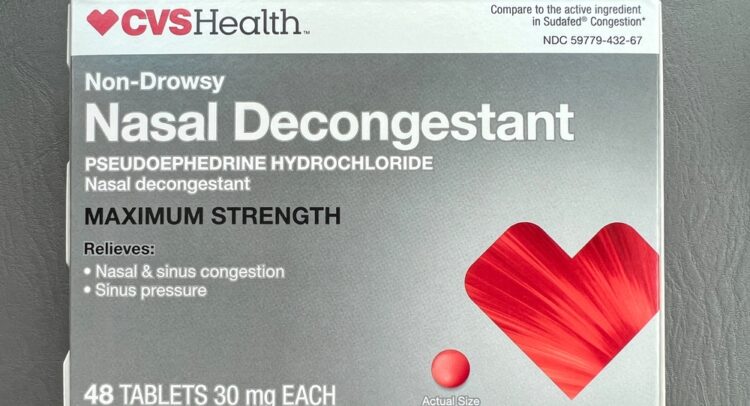

Retail pharmacy chain CVS Health (NYSE:CVS) has decided to voluntarily empty decongestants containing phenylephrine from its store shelves and stop selling them completely. The drug company’s decision follows a finding by a panel of advisors to the U.S. Food and Drug Administration (FDA) in September that phenylephrine alone was not effective in clearing nasal congestion when consumed orally.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Common over-the-counter (OTC) medicines for cold and allergies usually contain phenylephrine. CVS is removing only those decongestants that contain phenylephrine as the only active ingredient in the medicines. It will continue to sell other cold and cough medicines to customers. OTC drugs usually generate a high revenue base for drug retailers. As per the FDA stats, American retail stores sold 242 million bottles of drugs containing phenylephrine ($1.8 billion in sales) in 2022, up 30% from the prior year.

Importantly, the FDA has not yet announced its decision to withdraw such drugs from store shelves. It remains to be seen whether other drug companies, such as Walgreens Boots Alliance (NASDAQ:WBA) and Kenvue (NYSE:KVUE), also voluntarily decide to withdraw these drugs. Should the FDA come up with any decision to remove sales of phenylephrine-containing drugs, it could push pharma companies to innovate newer drugs. Moreover, liquid and spray versions of these drugs, which were not included in the FDA panel’s research, could receive a boost from such a decision.

Is CVS a Buy or a Sell?

On TipRanks, CVS stock commands a Strong Buy consensus rating. This is based on 15 Buys versus three Hold ratings. The average CVS Health price target of $90.81 implies 28.6% upside potential from current levels. Year-to-date, CVS stock has lost 22.2%.