Healthcare company CVS Health Corp. (NYSE: CVS) was up in pre-market trading at the time of writing on Wednesday even as the company’s adjusted earnings declined by 12.6% year-over-year to $2.21 per share in Q2 but above consensus estimates of $2.12 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s total revenues increased by 10.3% year-over-year to $88.9 billion but ahead of Street estimates of $86.41 billion.

Looking forward, CVS expects adjusted earnings in FY23 in the range of $8.50 to $8.70 per share. Cash flow from operations in FY23 is likely to be between $12.5 billion and $13.5 billion.

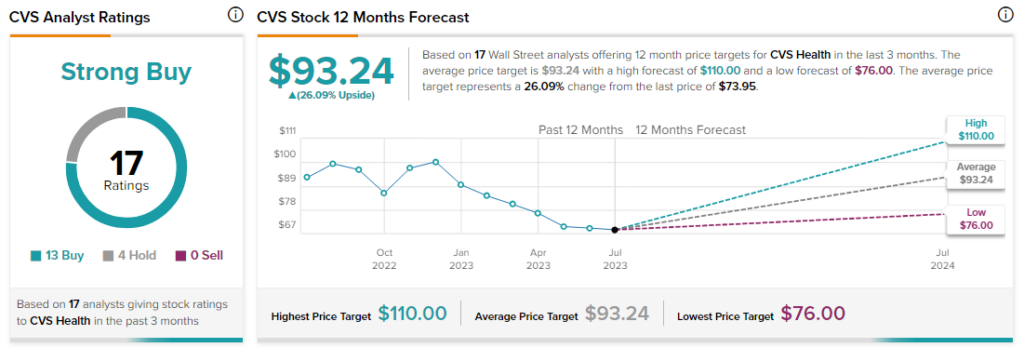

Analysts are bullish about CVS stock with a Strong Buy consensus rating based on 13 Buys and four Holds.