Last updated: 8:38 AM EST

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Shares of CureVac (NASDAQ:CVAC) continued with their momentum in pre-market trading on Monday as they surged another 25%. The upside was due to positive preliminary data from the Phase 1 study of modified mRNA-based COVID-19 and seasonal flu vaccine candidates.

The biopharmaceutical company plans to move forward with the “next stage of clinical testing” for these vaccines later this year. It is worth highlighting that CureVac is co-developing the vaccines with GlaxoSmithKline (GSK).

CureVac’s COVID-19 candidate CV0501 increased the production of antibody titers in young adults against the Omicron variant. Also, the vaccine was “well tolerated” by all the dosage groups in the trial.

Furthermore, the flu vaccine candidate, Flu-SV-mRNA, boosted antibody titers against matching flu strains. It was also well tolerated across all tested dose groups and showed no safety concerns.

CureVac CEO Franz-Werner Haas said that these positive results demonstrate the strength of the company’s proprietary mRNA-technology platform and will lead to “new opportunities in the development of effective prophylactic vaccines and also for advancement of our robust oncology strategy.”

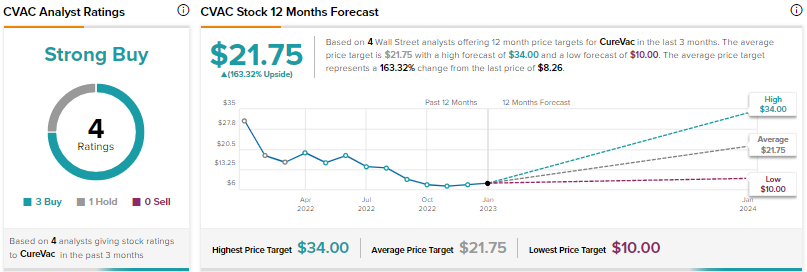

Is CVAC a Buy, Hold, or Sell Stock?

Jeffries analyst Eun Yang upgraded CVAC stock to Buy from a Hold and also bumped up the price target to $21 from $9 earlier following the positive clinical results.

Yang’s price target implies an upside potential of 154.2% at current levels.

CureVac has a Strong Buy consensus rating based on three Buys and one Hold. The average CVAC stock price target of $21.75 implies 163.3% upside potential from the current level.