Shares of Cisco Systems (NASDAQ:CSCO) are slightly down at the time of writing, which can be attributed to analyst comments about Cisco’s sagging order book, despite their Q3 numbers beating the odds. Analyst Thomas Blakey of KeyBanc Capital Markets is concerned about a slump in enterprise orders, which saw a 22% dip. Plus, he’s worried about a soft spot in the company’s product revenue segment, a big piece of the pie that makes up 76% of revenues.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, analyst Sebastien Naji of William Blair notes a slowdown in momentum as customers are taking their sweet time placing orders. He sees potential for Cisco in the emerging field of generative artificial intelligence but is concerned about losing ground in areas like networking, security, and collaboration. Furthermore, J.P. Morgan analyst Samik Chatterjee believes the order shortfalls are a real issue, expecting it to cast a shadow over the next few quarters.

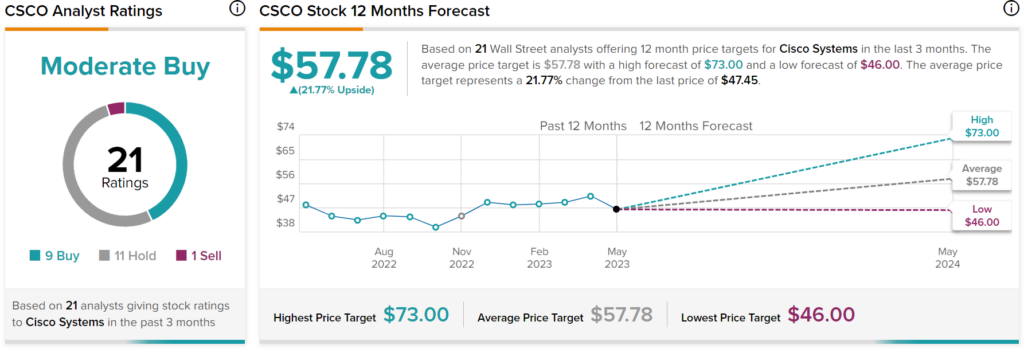

Overall, Wall Street analysts have a consensus price target of $57.78 on CSCO stock, implying 21.77% upside potential, as indicated by the graphic above.