The rush to build AI infrastructure is creating a new generation of cloud computing names. Two companies in the spotlight are CoreWeave (CRWV) and Nebius (NBIS), both key players in providing the cloud solutions that fuel AI applications. This comparison highlights recent deals and Wall Street’s take on both stocks, helping investors make a more informed choice.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both CoreWeave and Nebius are AI infrastructure companies, helping businesses run AI workloads in the cloud. CoreWeave focuses mainly on specific workloads like AI training, visual effects, and batch processing. Meanwhile, Nebius offers a full-stack AI infrastructure, including hardware (GPUs), software, and cloud services, making it a broader platform.

CoreWeave (NASDAQ: CRWV)

CRWV stock has soared more than 240% since its March 2025 IPO. Driven by strong demand for AI infrastructure and major partnerships, CoreWeave has rapidly emerged as a top tech stock. This impressive growth is particularly striking considering its challenging debut, which faced low subscription levels and a lowered price range.

In Q2 2025, the company reported negative EPS of $0.60, falling short of the -0.23 consensus estimate. However, sales surged 206.7% year-over-year, with revenue reaching $1.21 billion, above analysts’ expectations of $1.08 billion. Despite its capital-heavy model, investors are focused on the triple-digit revenue growth, with the company guiding full-year 2025 revenue of $4.9–$5.1 billion.

Additionally, the company’s high-profile deals in 2025 highlight its progress in diversifying customers and expanding its backlog. In September, CoreWeave and OpenAI (PC:OPAIQ) expanded their partnership with a $6.5 billion cloud deal, bringing the total collaboration to $22.4 billion. Similarly, CoreWeave signed a new order deal with AI chipmaker Nvidia (NVDA). Initially valued at $6.3 billion, the agreement allows Nvidia to purchase any unsold cloud computing capacity from CoreWeave through April 13, 2032.

Top Analyst Stays Bullish on CRWV Stock

Earlier this month, five-star-rated analyst Amit Daryanani at Evercore ISI reiterated his Buy rating on CRWV stock. Daryanani stated that although the company’s GPU cloud business requires heavy spending and debt, its model remains strong, well-managed, and profitable at scale, even with higher depreciation costs.

He added that CoreWeave’s long-term contracts and key partnerships make its business resilient and positioned for sustained profitability.

Nebius Group (NASDAQ: NBIS)

NBIS stock has surged by 385% in 2025, fueled by strong demand for AI computing and optimism about its ability to secure major contracts. In the past 30 days, NBIS stock has surged nearly 50%, driven by a multi-year deal with Microsoft (MSFT) to supply AI infrastructure. The agreement is valued at $17.4 billion through 2031, with the potential to reach $19.4 billion if Microsoft opts for additional computing capacity.

Apart from Microsoft, other tech giants are also heavily investing in expanding their AI infrastructure and may turn to Nebius for additional capacity. Meanwhile, smaller firms that can’t afford to build their own GPU infrastructure are likely to rent resources from Nebius as needed. This positions Nebius to attract a wide range of customers, from Big Tech to startups.

Wall Street Backs NBIS on Microsoft Deal

Top-rated analyst Hamed Khorsand of BWS Financial views the Microsoft deal as a major milestone, noting that the tech giant will use nearly all of Nebius’s New Jersey facility. He added that the contract could help Nebius attract more large-scale clients as it expands to additional U.S. locations.

Earlier this month, five-star-rated analyst Nehal Chokshi at Northland Securities raised his price target on NBIS to $206.00 from $77.00 while maintaining a Buy rating. Chokshi said Nebius Group’s Microsoft deal reflects its strong market position, “scarcity value,” and attractive economics. He added that Nebius’ cost advantages and top-notch engineering helped the company win the contract.

CRWV or NBIS: Which Stock Offers Higher Upside, According to Analysts?

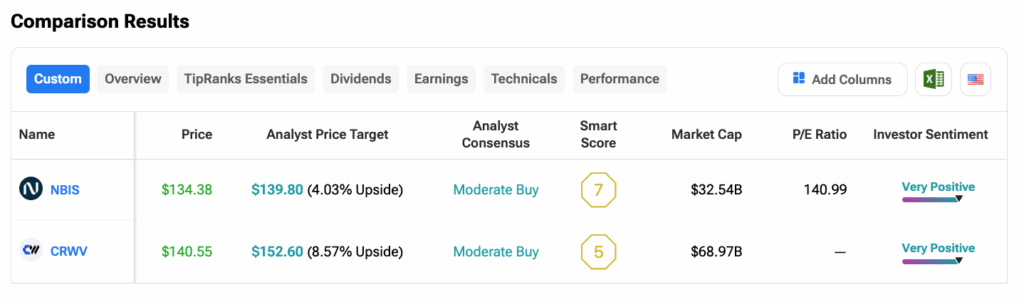

Using TipRanks’ Stock Comparison Tool, we compared NBIS and CRWV to see which AI stock analysts favor. Both CRWV and NBIS have Moderate Buy ratings from analysts. At $152.60, the average CoreWeave stock price target suggests over 8% upside from current levels. In comparison, NBIS has a price target of $139.80, indicating a more modest upside of 3.7%.

Conclusion

In summary, both CoreWeave and Nebius are strong players in the fast-growing AI infrastructure race, but they appeal to different types of investors. Nebius offers more stability and visibility thanks to its major Microsoft partnership and institutional backing, making it a steadier long-term pick.

CoreWeave, on the other hand, presents a higher-risk, higher-reward opportunity. Its Nvidia ties and strong growth momentum could deliver outsized gains if execution remains strong.