It would be easy to scoff at the notion that things are improving for cruise stocks. But at least two of them—Royal Caribbean (NYSE:RCL) and Carnival (NYSE:CCL)—are up in Tuesday morning’s trading. One of the biggest causes of this was some fresh love put out by Truist, who noted that the overall environment for cruise lines is improving.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Truist, by way of analyst Patrick Scholes, noted that supply of cruises may be increasing, but so too is demand. And demand is actually rattling along harder than supply is, making for the perfect environment to supply cruises. The trends going forward look even better, with sales for next year up between 55% and 60% against 2019’s figures. Meanwhile, the projections for 2025 are actually double what 2019 produced. And with share prices off their July highs, there’s a very real chance that a rapid buy-in could take things up still further.

Furthermore, Royal Caribbean is rolling out a new ship called “Utopia of the Seas,” which recently touched water for the first time as it moves to “wet dock” construction. When completed in Summer 2024, it will be the sixth Oasis-class vessel in Royal Caribbean’s fleet. It will also have a new tiki bar experience and the “longest dry slide at sea,” the Ultimate Abyss, measuring nearly 300 feet. Carnival, meanwhile, now boasts oceangoing roller coasters but recently announced a plan to phase out its library.

Is Royal Caribbean Stock a Buy or Sell?

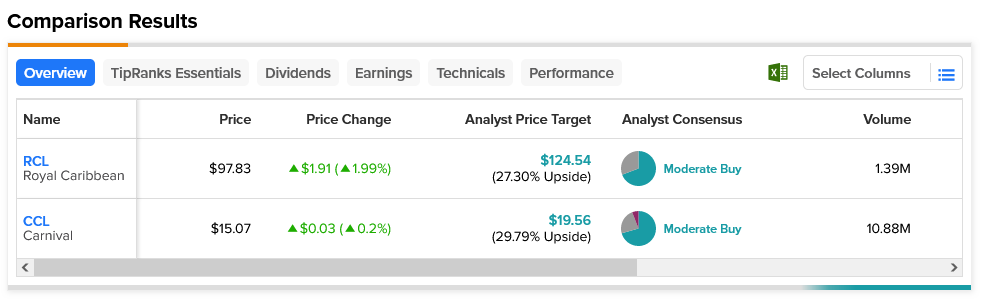

Interestingly, both Royal Caribbean and Carnival are considered Moderate Buys by analyst consensus. And their upside potential isn’t much different, either. With an average price target of $124.54, Royal Caribbean offers 27.3% upside potential. Meanwhile, Carnival offers 29.79% upside potential on its average price target of $19.56.