Exxon Mobil’s (XOM) stock has been largely stagnant in recent years, trading near the same levels seen in late 2022. This lack of momentum persists despite the company arguably being in a stronger financial and operational shape today. The stock’s performance has closely mirrored crude prices — with WTI hovering in the high-$50s and Brent in the low-$60s, territory not seen since early 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, this period of stagnation could set the stage for a meaningful opportunity. Exxon boasts one of the strongest balance sheets in the energy sector, with ample liquidity, disciplined capital spending, and a sector-leading dividend. If oil prices rebound even modestly from current levels, the combination of Exxon’s financial strength and operational leverage gives the stock significant upside potential.

Given this setup, I remain Bullish on Exxon Mobil and view the current weakness as a potential long-term entry point.

Why Oil Dropped, and Why It Should Bottom

This latest leg down in oil is primarily a supply story. The International Energy Agency flagged a sizeable global surplus into 2026, which spooked traders and pulled futures to multiyear lows. Brent near $62 and WTI around $58 suggest that the market has bought the IEA’s oversupply narrative, at least for now.

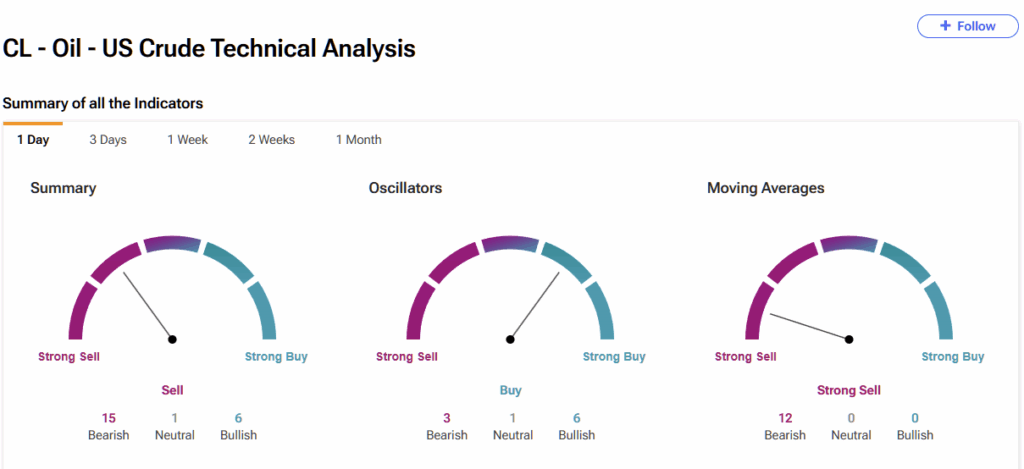

From a technical analysis perspective, crude oil has a mixed picture with moving averages pointing lower while momentum oscillators are bullish, according to TipRanks data.

When you also consider somewhat jittery U.S.–China trade headlines and a modest OPEC+ production tweak, you’ve got a recipe for softer prices in the short run.

Moreover, zoom in on the U.S., and you can see the mix shifting. Shale growth has slowed while offshore Gulf of Mexico projects are doing more of the incremental heavy lifting. Sure, that’s great for long-term capacity. Still, it doesn’t change the near-term fact that at sub-$60 WTI, marginal barrels get uneconomic fast, which historically encourages producers and OPEC+ to tighten the taps.

Even Vitol’s Ben Luckock (hardly a permabull) suggested that dips into the $50s wouldn’t last. In other words, the fundamental rubber band looks stretched, and 2021-like price levels tend to attract policy and supply responses, so I believe oil prices may, in fact, bottom around here.

Balance Sheet First, Then Buybacks

Now, even with uninspiring oil prices today, Exxon stayed plenty profitable and used the cash to get lean. Net debt is low, and leverage is tiny, with its roughly 0.4x net debt to LTM EBITDA, placing Exxon at the conservative end of the majors. Management also noted a single-digit net-debt-to-capital ratio (about 8% mid-year) after further paydown in 2025. That gives Exxon flexibility if oil stays depressed.

But just to highlight Exxon’s profitability prowess, even following consistent deleveraging in recent years, the company has also been retiring stock at a brisk clip.

In 2021, repurchases were a token at just about $0.15 billion, but in 2022 they jumped to $14.9 billion. In 2023, buybacks rose again to $17.4 billion, and in 2024, they pushed to almost $20 billion (and the company extended a $20 billion per-year plan through 2026). Year-to-date, Exxon has already repurchased $9.8 billion, and it’s chewed through about 40% of the shares it issued to fund the Pioneer deal.

XOM Earnings Set to Rebound as Oil Cycles Bottom Out

Earnings expectations mirror the somewhat depressed oil prices, with the consensus calling for EPS to decline in 2025. However, the market expects a rebound in 2026, which is what you’d expect if this is a cyclical trough for crude. Latest estimates point to $6.79 EPS for 2025 (down 12.8% YoY) and a move back toward $7.41 in 2026 as prices stabilize, based on expectations of an oil price rebound.

Given these estimates, I don’t believe the valuation is stretched for a company with Exxon’s asset base. This year’s P/E sits at around 16.5x, and FY2026’s estimate falls to 15.2x. These multiples leave room for an expansion if oil prices bounce and buybacks continue to shrink the denominator.

Note that the sector average forward P/E stands at 13.1x, which might imply that XOM is overvalued. However, note that the sector includes many E&P names that naturally trade at lower multiples due to their higher-risk business models.

Regardless, if you’re wondering whether oil prices have to cooperate for this thesis to work, here’s how I see it. Even at today’s strip, Exxon can comfortably fund its capex, dividends, and buybacks—thanks to a stronger balance sheet, lower costs, and a higher-quality asset base. But if crude moves into the mid-$60s or higher, the math turns compelling pretty quickly: a cleaner balance sheet means more free cash flow converts directly into repurchases, and with fewer shares outstanding, that EPS accretion will become hard to ignore.

Is Exxon Mobil a Buy, Sell, or Hold?

Wall Street remains relatively bullish on Exxon, with the stock carrying a Moderate Buy consensus rating based on 11 Buy and seven Hold ratings over the past three months. Notably, not a single analyst is bearish on the stock. Moreover, XOM’s average stock price target of $126.65 suggests almost 14% upside from current levels.

XOM’s Structural Strength Positions It for the Next Upturn

Oil prices may appear washed out, hovering near multi-year lows, but Exxon Mobil today is not the same company it was during prior downcycles. The balance sheet is among the strongest in the sector, leverage is minimal, and cash returns to shareholders are now structural rather than opportunistic. Continuous efficiency gains and disciplined capital allocation have supported steady share count reduction, further amplifying per-share metrics over time.

The oiler’s valuation remains modest relative to its historical averages and to peers, despite a cleaner cost base and a portfolio positioned to benefit from any cyclical recovery in crude prices. With earnings likely to re-accelerate as the macro environment stabilizes, Exxon offers a rare mix of defensive strength and upside optionality. In my view, that combination makes this recent pullback an attractive entry point for long-term investors.